Taxpayers Can Obtain Exemption from Tax Agent Obligations Regarding Jewelry Without Primary Documents

To take advantage of this benefit, it is necessary to register the corresponding electronic document in the electronic invoice system by March 1, 2026.

To enter the required data, you should log into the electronic invoice system at the website esf.salyk.kg, select the "Acquisition" section, and then proceed to the DPBU subsection.

In the upper right corner of the interface, you need to click the "Add" button. In the dialog window that opens, you should select the item "Entering information about precious jewelry made of precious metals."

When this option is selected, the main data of the electronic document will be generated automatically. The taxpayer only needs to fill in the goods section of the document in accordance with the requirements outlined in paragraph 19 of the Procedure for the registration and application of invoices, approved by the order of the State Tax Service dated April 28, 2023, No. 101 (with amendments from the order of the State Tax Service dated January 14, 2026, No. 4).

It is important to note that this electronic document cannot be modified or declared invalid. Therefore, the taxpayer must provide all information accurately and without errors, as the entered data will be taken into account and cannot be changed or canceled.

Note:

A tax agent can be either an organization or an individual entrepreneur who is required to calculate, withhold, and remit taxes related to other taxpayers to the budget.

Read also:

GNS: How to Free Yourself from Liability for Jewelry Without Primary Documents

Taxpayers have the opportunity to be exempt from tax liability for jewelry made of precious metals...

The GNS explained how to obtain an exemption for jewelry without documents

The State Tax Service (STS) has announced the possibility of exempting taxpayers from liability and...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

"Ay-Pery" has transformed into an international business center — photo report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Cabinet clarified the procedure for accumulating funds in special accounts of budgetary institutions

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Cabinet approved the preparation plan for the anniversary Issyk-Kul Forum named after Chyngyz Aitmatov.

The Cabinet of Ministers of the Kyrgyz Republic approved measures for the preparation of the...

Torture of Patients. The GKNB Reveals Shocking Rehabilitation Methods at the "Path to Life" Center

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

By March 1, cryptocurrency exchanges must raise their minimum authorized capital to 10 billion soms.

- On December 31, 2025, the government adopted a resolution regarding the regulation of the virtual...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

Rest in Goa: A Guide for Kyrgyzstanis on the Main Tourist Destination in India

Goa is one of the most vibrant and attractive tourist regions in India. Here, everyone will find...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Tax Service of the Kyrgyz Republic spoke about the liability for using electronic wallets registered to individuals in business activities.

According to the banking legislation of the Kyrgyz Republic, entrepreneurs are required to conduct...

Online Entertainment and User Interest

After the first login, the user determines how convenient it is to continue. If the actions are...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

Recent discussions on social media and in the media have revealed that many sellers in markets...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

In Bishkek, the organization of closed private parties for adults has been shut down.

In Bishkek, an organization conducting closed private parties for adults was identified, according...

A Major Loan Shark and Owner of a Pawnshop Chain Arrested

In Bishkek, law enforcement agencies detained a well-known loan shark and owner of a chain of...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Why Bishkek Residents Received High Gas Bills and What Do New Meters Have to Do with It

In the first week of January, residents of Bishkek began actively reporting receiving high gas...

The GKNB detained a man near a bank while receiving 3000 dollars — the court issued a verdict

The judicial panel of the Bishkek City Court has decided to terminate the criminal case against two...

Re-registration of Individual Entrepreneurs now takes up to 10 minutes

Recently, the tax service of Kyrgyzstan launched a new online service for the re-registration of...

The Tax Service suspended raids and control purchases from entrepreneurs, including those involving QR codes.

The State Tax Service (STS) has announced the suspension of raid inspections and control purchases...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

Bishkek Enters the Cycle of Revaluation of the Royal Central Park Real Estate Market and the Advantage of Price Fixation in the First Three Years

The economy, which is on the path of rapid and stable growth, leads to an increase in real estate...

Who is a conscientious taxpayer? The Tax Service of Kyrgyzstan explained in a funny video

Many people mistakenly believe that a taxpayer is simply someone who fulfills their tax...

Kamchybek Tashiev inspected the border checkpoint "Bek-Abad" and stated the need for repairs

On January 1, 2023, the Deputy Prime Minister and Head of the State Committee for National...

Employees of weight and dimension control detained for extorting money from drivers

As a result of operational measures, seven employees of the weight and dimension control on the...

Visa to the USA "secured by collateral": what Kyrgyzstanis need to know about the new rules

The U.S. Department of State recently included Kyrgyzstan in the list of countries participating...

Nelly Nosalik: Advertising on Social Media - The Most Promising Direction

In Kyrgyzstan, there is a growing interest in women's entrepreneurship in the field of...

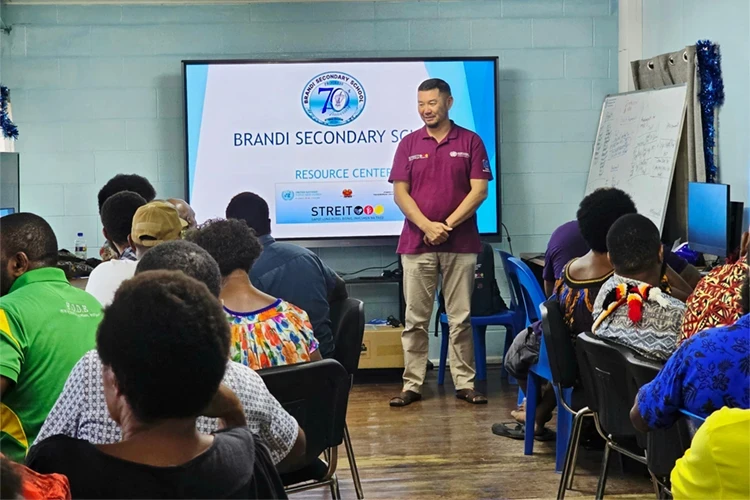

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

What is happening with green cards? Should we expect the lottery? And what about those who have already won it?

The U.S. Green Card Lottery (Diversity Visa Lottery) has long served as one of the most accessible...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

The Tax Service of Kyrgyzstan has temporarily suspended raid inspections and test purchases among small and medium-sized businesses.

The suspension concerns the conduct of raid inspections regarding compliance with tax legislation,...

The head of the State Committee for National Security inspected the "Bek-Abad" border checkpoint and stated the need for repairs.

On January 1, an unscheduled working visit was made by Kamchybek Tashiev, who holds the position...

Kamchybek Tashiev handed over 34 vehicles to the Motherhood and Childhood Protection Center

On January 1, in the Jalal-Abad region, 34 cars were handed over to the employees of the National...

The last days of the year will replenish the treasury. Horoscope from December 29 to January 4

The week leading up to the New Year inspires rest, travel, and celebrations. A key moment will be...

The first 15 family offenders in Bishkek received electronic bracelets

Photo 24.kg. Offenders in Bishkek have been fitted with electronic bracelets. Archive photo A new...

A new prosecutor's office building opened in the Alai District

The opening of a new administrative building of the prosecutor's office took place in the...

Year Results from Tazabek. Over 30,000 enterprises in Kyrgyzstan earned nearly 800 billion soms in 2024.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

"War Will Change Beyond Recognition." Colonel of the General Staff of Russia — on the Lessons of Military Actions in Ukraine, Changes in the Army, and the Weapons of the Future

The conflict in Ukraine has not only become a catalyst for changes in the military sphere but has...

A Unified Policy for Livestock Markets Will Be Implemented in the Chui Region

A unified policy regarding livestock markets will be implemented in the Chuy region. This was...

The U-20 World Ice Hockey Championship has started in Bishkek

The U-20 World Hockey Championship started in Bishkek on January 18. This was announced by the...

A Food Fair is Taking Place in Bishkek

At the Turdakun Usubaliev Square in Bishkek, a fair has been organized by the Ministry of Water...