To obtain such an exemption, it is necessary to register the corresponding electronic document in the electronic invoice system by March 1, 2026.

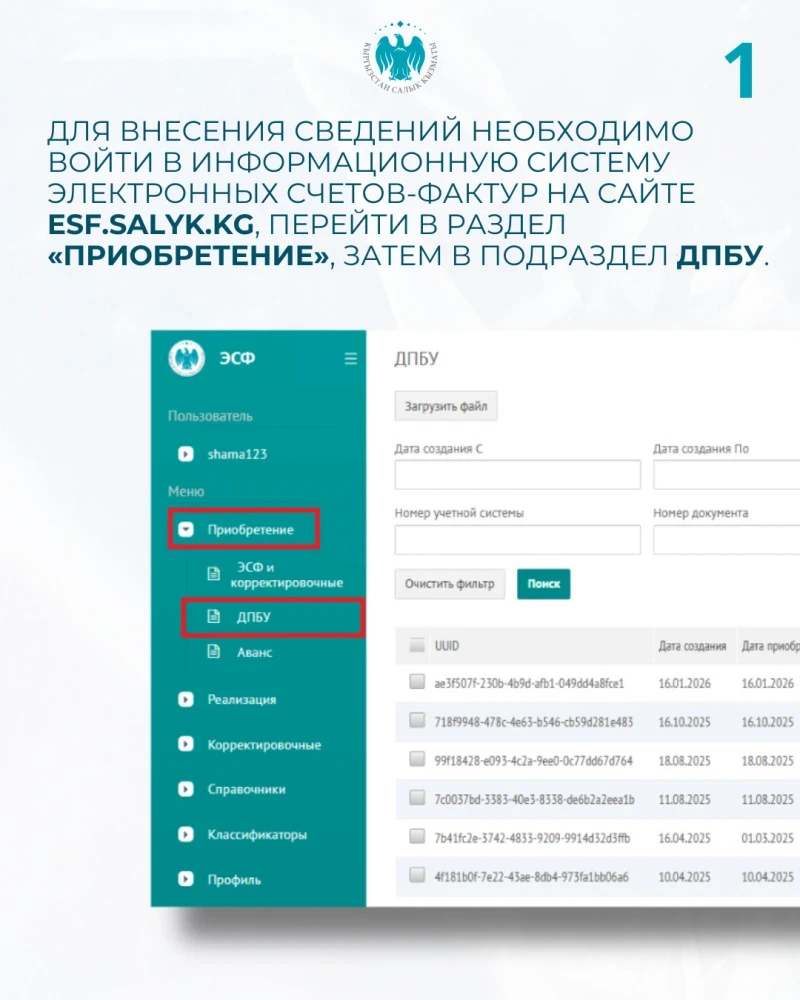

- Access to the system is through the website esf.salyk.kg. Then, you need to go to the "Acquisition" section and select the DPBU subsection.

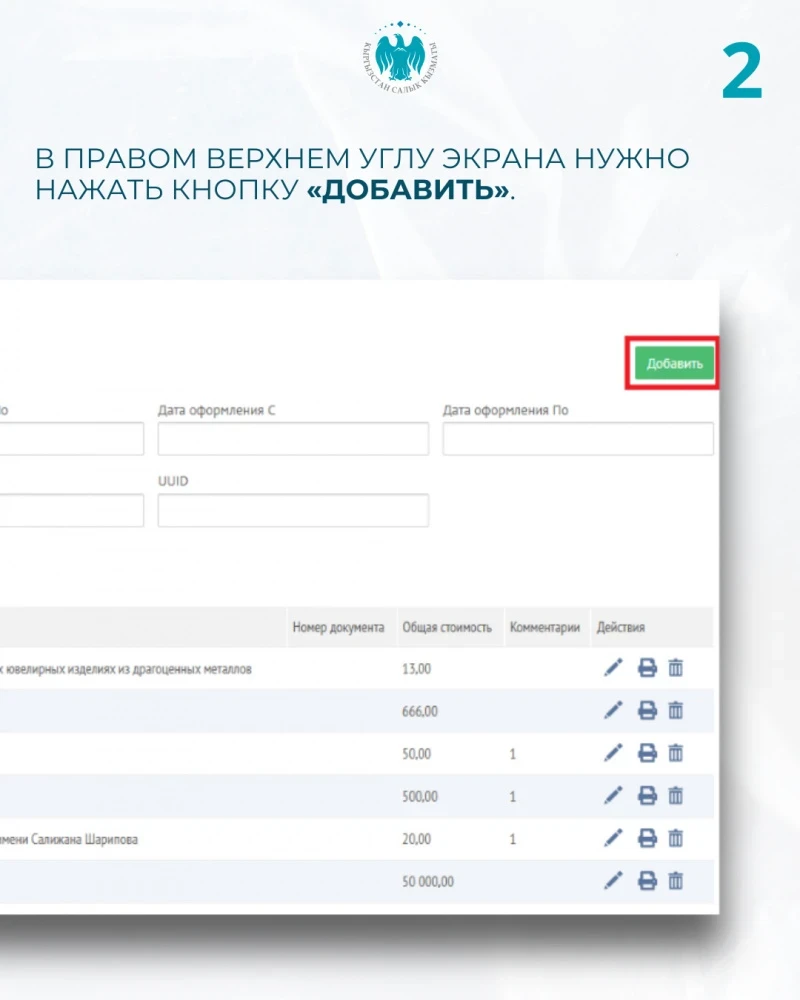

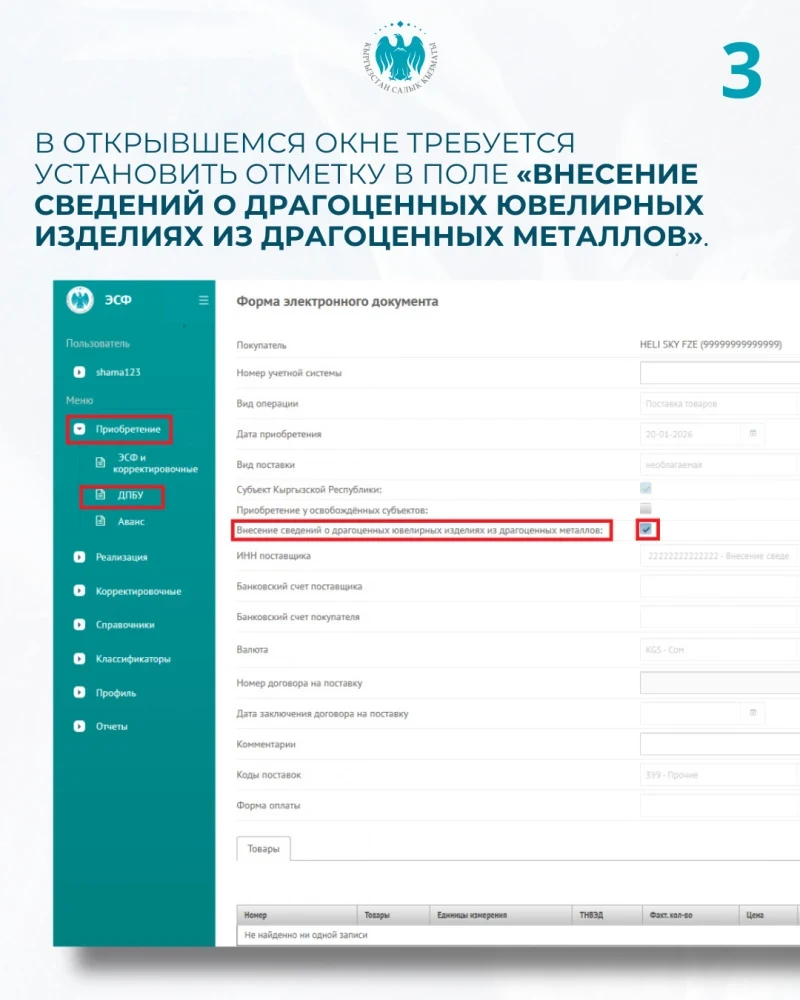

- In the upper right corner of the page, you should click the "Add" button. In the opened window, check the option "Entering information about precious jewelry made of precious metals."

- When selecting this option, the main details of the document will be filled in automatically. The taxpayer only needs to enter information about the goods, following the procedure established by paragraph 19 of the Procedure for the registration and application of invoices, approved by the order of the State Tax Service dated April 28, 2023, No. 101, with amendments from January 14, 2026, No. 4.

It is important to note that this electronic document cannot be changed or declared invalid.

Therefore, the taxpayer must ensure the complete, accurate, and error-free filling of all information, as the entered data is subject to mandatory accounting and cannot be canceled or changed later.