The State Tax Service suspended raid inspections among small and medium-sized businesses

This decision is the result of a desire to support entrepreneurs in the context of a difficult economic situation, reduce administrative pressure, and create more favorable conditions for business development.

In particular, inspections related to compliance with tax legislation regarding the use of cash register equipment (CRE), invoices, and equipment for cashless payments, as well as the availability of primary documents for goods for individual entrepreneurs who operate:

— under a simplified taxation system with a single tax rate of 0 and 0.5 percent;

— based on a patent;

— in trade zones with a special taxation regime;

— in the sewing or textile industry with a single tax rate of 0.25 percent.

However, the exemption from inspections does not apply to businesses that:

— operate without tax registration or without paying tax under a patent;

— have complaints or statements from citizens or organizations, as well as decisions from investigative bodies;

— have confirmed data on tax evasion, including taxes on hired workers;

— engage in the turnover of excise goods, which requires verification of the presence of excise stamps.

In addition, measures will be taken to enhance informational work among entrepreneurs regarding the use of CRE, invoices, and cashless payment technologies, including bank cards and QR codes.

Comprehensive support for entrepreneurs will also be provided on issues of compliance with tax legislation, including the use of invoices and CRE.

Read also:

The Tax Service suspended raids and control purchases from entrepreneurs, including those involving QR codes.

The State Tax Service (STS) has announced the suspension of raid inspections and control purchases...

The Cabinet has determined the list of government agencies where certain graduates will be enrolled in the reserve for senior positions without competition.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Tax Service of the Kyrgyz Republic spoke about the liability for using electronic wallets registered to individuals in business activities.

According to the banking legislation of the Kyrgyz Republic, entrepreneurs are required to conduct...

The law on amendments to taxes, social insurance, and non-tax revenues has been adopted. What will change?

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a law concerning changes in the...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Kyrgyzstan Seeks Solutions to Export Issues for Textile Products to Russia

- Since autumn 2025, the sewing enterprises of Kyrgyzstan have found themselves in a difficult...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

Recent discussions on social media and in the media have revealed that many sellers in markets...

Reduced rate of the single tax for activities conducted outside the territory of the country

The State Tax Service of the Kyrgyz Republic has announced a reduction in the unified tax rate for...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

New Tax Benefits: Key Changes for Citizens and Entrepreneurs

The President of Kyrgyzstan, Sadyr Japarov, has approved a new law concerning amendments to a...

"Neither Drive Nor Walk". Residents of Osh Complained About the Condition of One of the Streets

Residents of Kayyrma Street contacted the Call Center Kaktus.media to express their concerns about...

At the GNS, issues of cashless payments were discussed

Recently, a working meeting was held at the State Tax Service of the Kyrgyz Republic, where...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

At the GNS, issues and prospects for the development of cashless payments were discussed

The State Tax Service (STS) recently organized a working meeting focused on current issues related...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

A bill providing tax benefits for certain sectors of the economy has been adopted by the Jogorku Kenesh.

The draft law includes a number of measures aimed at the comprehensive development of the jewelry...

The Cabinet clarified the procedure for accumulating funds in special accounts of budgetary institutions

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Open a Company in Hong Kong

Hong Kong, due to its strategic location, has become a crucial point in global commerce. Opening a...

Business explains why it does not trust electronic individual entrepreneur accounts

As mentioned in previous materials, the situation with digitalization in Kyrgyzstan has changed...

Business Support: Taxes Reduced and Certain Licenses Abolished

President Sadyr Japarov has approved a draft law that amends various legislative acts related to...

The GNS Discussed Issues of Cashless Payments Involving Banks, the NBKR, and Relevant Government Agencies

The State Tax Service (STS) organized a working meeting focused on the development of cashless...

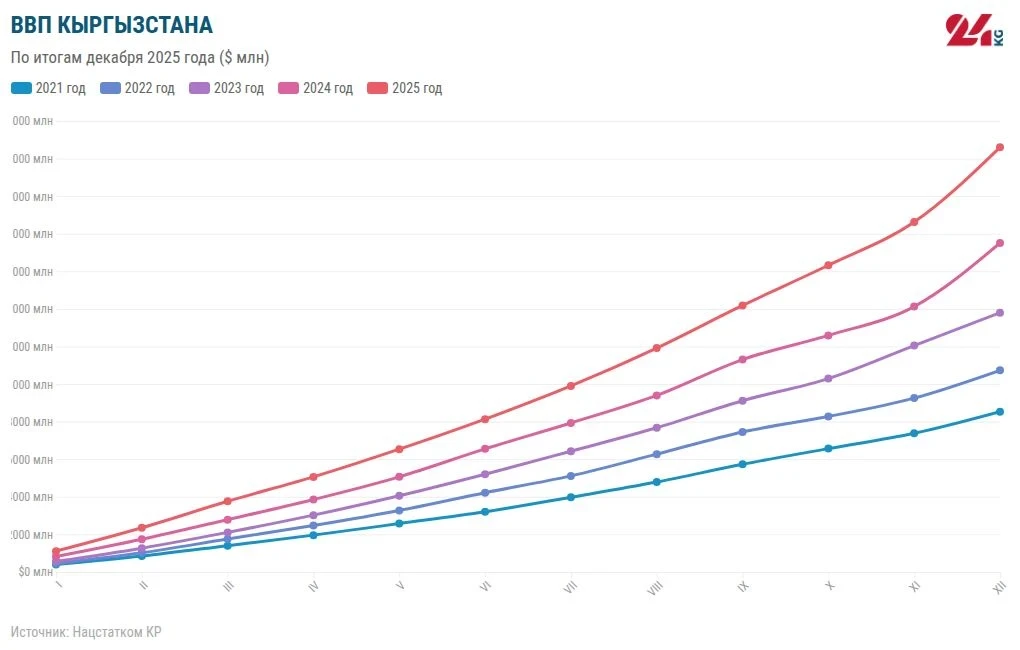

The GDP of Kyrgyzstan for the year 2025 amounted to nearly 2 trillion soms

According to preliminary data, the gross domestic product of Kyrgyzstan for the year 2025 amounted...

From Cash to Smartphone: Why Kyrgyzstan is Rapidly Moving Towards Cashless and QR Payments

When was the last time you paid in cash? For most citizens of Kyrgyzstan, cashless payments have...

In Bishkek, an underground workshop for producing counterfeit vodka was discovered

As a result of a raid conducted by the employees of the State Tax Service, an illegal workshop...

The GNS answered farmers' questions at the fair in Bishkek

On January 10, 2026, the first day of the fair in Bishkek, the team from the State Tax Service...

Stable, Pragmatic, and Gradually Developing Relations - Ambassador of Kazakhstan Rapil Zhoshybaev (Interview)

The Extraordinary and Plenipotentiary Ambassador of Kazakhstan to Kyrgyzstan, Rapil Zhoshybaev,...

Mongolia is Preparing for a Major Tax Reform

The presentation of the tax reform package took place in parliament. At its last meeting, the...

Markets and Stores in Kyrgyzstan Announce Boycott of Electronic Wallets

Markets and shops in Kyrgyzstan are witnessing a return to old payment methods. Customers, who...

The Ministry of Health instructed to create a database of unscrupulous participants in the pharmaceutical market and to strengthen control over drug procurement.

The Ministry of Health of Kyrgyzstan has announced its intention to create a registry of...

Life in the Regions: A Bullet in the Seat of a Honda — How One Detail Helped Investigator Kurmanbek Kanybek Uulu from Osh Uncover an Organized Crime Group

Kurmanbek Kanybek uulu — an investigator of the control and methodological department of the...

The Economy of Kyrgyzstan Grew by 11.1 Percent: Results of 2025

According to preliminary data, the gross domestic product (GDP) of Kyrgyzstan in 2025 amounted to...

New Benefits for the Sewing and Textile Industry Have Emerged

According to the State Tax Service of the Kyrgyz Republic, in accordance with the Law of the Kyrgyz...

Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

The president has signed a new law that introduces tax benefits for various entrepreneurs, as well...

Year Results from Tazabek. Over 30,000 enterprises in Kyrgyzstan earned nearly 800 billion soms in 2024.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The National Bank of the Kyrgyz Republic presented new rules for financial marketplaces

The National Bank of the Kyrgyz Republic (NB KR) has presented a draft of new rules regarding the...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

Salaries, retirement age, and new fines. What else will change in the KR in 2026

Starting from January 1, 2026, a comprehensive set of new laws will come into effect in Kyrgyzstan....

In Kyrgyzstan, the single tax rate for working abroad has been reduced

The rate has been reduced to 0.1 percent According to information from the State Tax Service, the...

The President signed a law on tax and administrative benefits for businesses and citizens

The document includes the cancellation and reduction of several taxes, as well as new rules in...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

According to the press secretary of the president, Askhat Alagozov, the head of state has signed a...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov has signed a new law concerning amendments to the legislation of the Kyrgyz...

The Federal Tax Service announced temporary tax benefits for the sale of passenger cars

The State Tax Service of the Kyrgyz Republic has announced the implementation of temporary tax...

Tax benefits for businesses and citizens are being introduced in Kyrgyzstan

Sadyr Japarov signed the Law of the Kyrgyz Republic "On Amendments to Certain Legislative Acts...

Benefits for entrepreneurs, legal entities, and individuals have come into effect

According to the new law signed by the President of the Kyrgyz Republic Sadyr Japarov, amendments...