From Cash to Smartphone: Why Kyrgyzstan is Rapidly Moving Towards Cashless and QR Payments

The sharp increase in the volume of cashless transactions is backed by a carefully crafted strategy from the National Bank of the Kyrgyz Republic, aimed at improving the transparency and accessibility of financial services. This is not just words, but a reality that Kyrgyz citizens have encountered.

Statistics confirm the effectiveness of the measures taken: since 2020, the number of cashless payments has been steadily increasing. Previously, there were fees for transfers made via phone number or card, and such operations were not conducted actively. However, after the decision by the NB KR to abolish fees for domestic transfers in November 2024, the volume of cashless operations surged. According to the NB KR, in the 11 months of 2025, 454.8 million payments were made through the interaction operator system, totaling 778.1 billion soms, which is 8.5 and 12.2 times more compared to the same period in 2024.

The decision to introduce cashless payments between banks was not made lightly. These services come with their costs: banks and financial companies incur expenses for clearing and other services, as all transactions pass through the regulator's systems.

Nevertheless, the National Bank, in making this important economic decision, set a more priority goal – to increase the use of cashless payments and expand access to financial services.

Notably, there has been a significant increase in cashless payments in the public services sector.

On December 3, 2025, the board of the National Bank again decided to extend the ban on charging fees. From January 1 to December 31, 2026, commercial banks and payment organizations are prohibited from charging commissions to individuals for transfers in the national currency within the country, conducted through mobile applications and internet banking.

The financial regulator emphasizes: "The practice of 2025 showed that the abolition of fees contributes to the rapid growth of online transfers. This makes cashless transactions more attractive to users and encourages a shift away from cash, facilitating the digitalization of the population's financial habits."

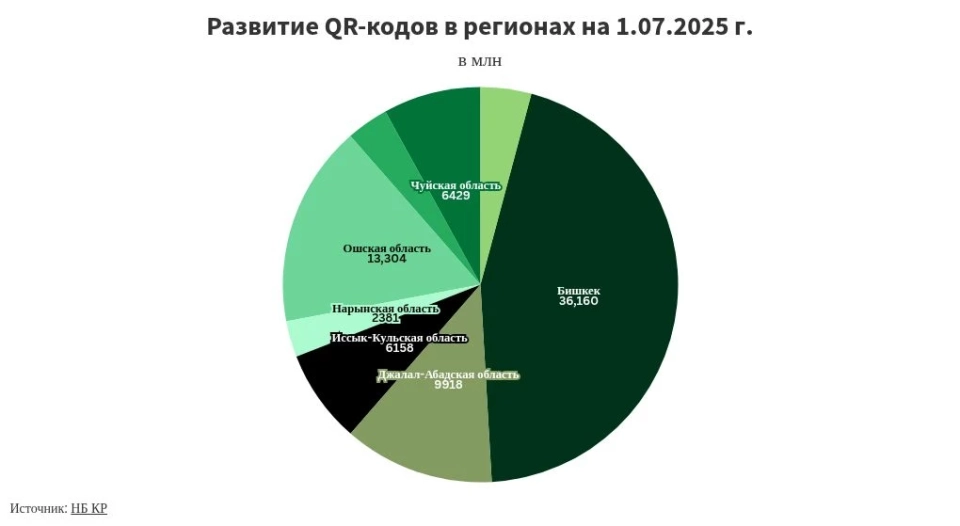

The development of cashless payments has also positively impacted the infrastructure of retail outlets. As of December 1, 2025, the country had installed 2,755 ATMs, 64,666 POS terminals for accepting payments and dispensing cash, as well as 21,529 payment terminals for working with cash. This is particularly noticeable in the regions, where cashless payments significantly simplify the process of paying for goods and services. Efforts to increase the volume of cashless operations will continue. Kyrgyzstan is already taking a leading position in the region in terms of the number of cashless transactions among the population, and the ability to conduct such operations abroad expands their application.

Read also:

The number of cashless trips on public transport in Bishkek is increasing

According to the information announced at a press conference by the Director of Operations for the...

Holders of "Tulpar" cards will be able to pay for transportation in Tashkent

The project for the implementation of cashless payments in public transport in Bishkek, called...

In 2025, taxes from the mining industry increased by 18.7 billion soms

According to the Tax Service, during the first 11 months of 2025, key sectors of the economy made a...

In 2026, Bishkek's buses will fully transition to cashless fare payment.

Currently, 80% of payments are made cashless According to Kaparov, the cashless system already...

Uzbekistan exported gold worth $10 billion from January to November

- In January-November 2025, Uzbekistan sold gold worth $9.8 billion, according to information...

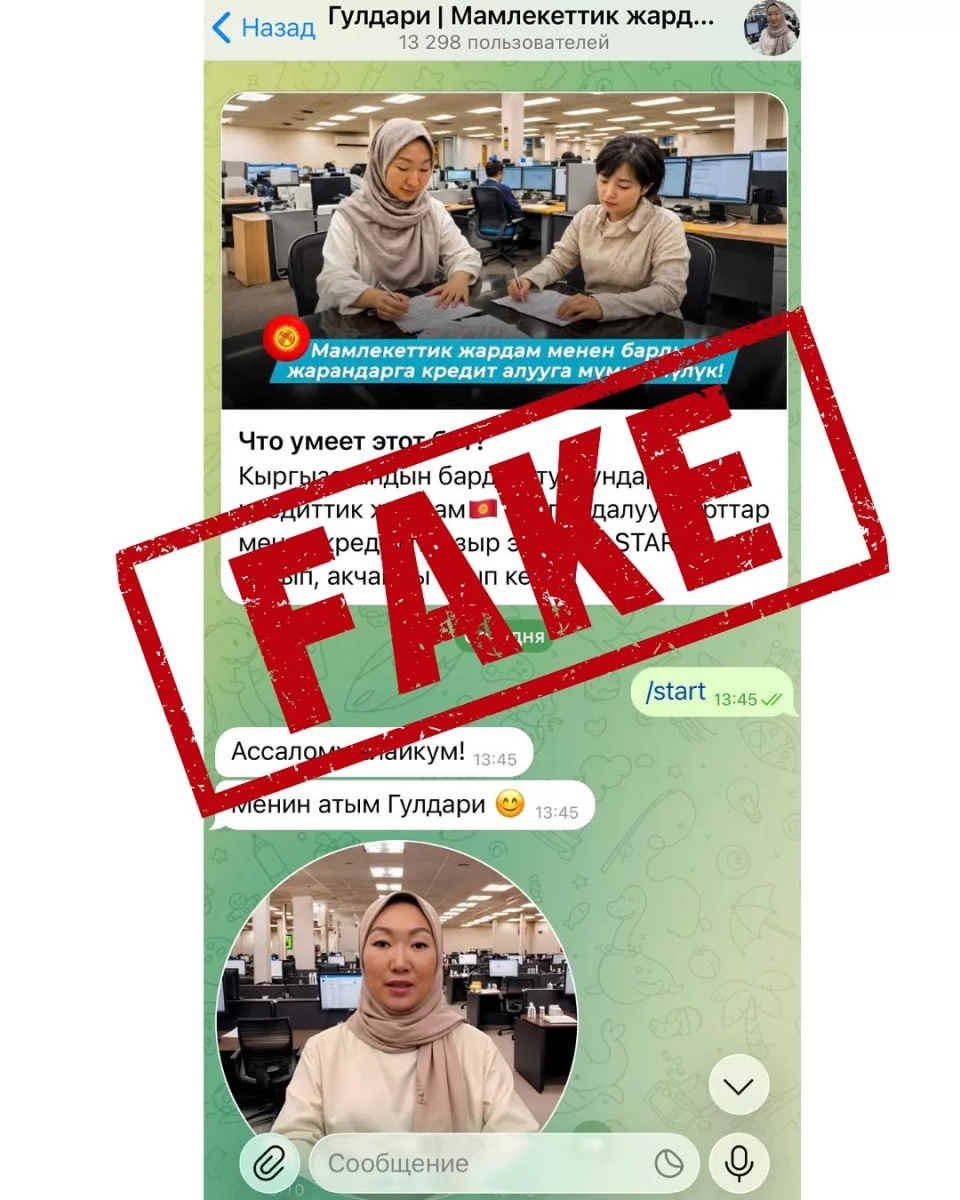

The National Bank of Kyrgyzstan Reminds and Again Warns About a Fraud Scheme in the Messenger Telegram

The National Bank once again draws attention to fraudulent schemes that are spreading through the...

Investments in manufacturing industries increased by 1.3 times from January to November

- According to statistical data, the volume of investments in fixed assets directed towards the...

The National Bank revoked the license of the credit union "Dividend" in the Batken region

- On December 23, 2025, the Batken regional office of the National Bank made the decision to revoke...

The Kyrgyz Republic is the 8th largest export market for Uzbekistan

- According to information from the National Committee of the Republic of Uzbekistan on Statistics,...

990 million soms allocated for the construction of the academic building of the Kyrgyz National University of Culture and Arts

On December 24, at a meeting of the Jogorku Kenesh, the Chairman of the Cabinet of Ministers,...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Investments in water supply and waste increased by 2.4 times, while trade saw a decrease of 37.9%

- As of the end of January-November 2025, the volume of investments in the construction of...

Some government services have become free: the cabinet has updated the unified registry of services

The government has made adjustments to its resolution regarding the Unified Register of State...

The GNS announced that for the first time in the history of independent Kyrgyzstan, it has prematurely fulfilled the plan for tax and payment collection.

The State Tax Service has successfully completed the approved plan for tax and payment collection...

NBKR and IFC Discussed Key Directions for the Development of Digital Finance in Kyrgyzstan

The National Bank of Kyrgyzstan, with the support of the International Finance Corporation (IFC),...

Fraud in Kyrgyzstan has become one of the most dangerous threats to society

At the IV People's Kurultai, President Sadyr Japarov pointed out that fraud has become one of...

In 2024, Kyrgyzstan ranked among the top three countries in the world for real GDP growth rates.

At the IV People's Kurultai, President Sadyr Japarov announced that, according to the...

Kyrgyzstan Increases Car Imports from China

According to data from the General Administration of Customs of China, from January to November of...

Adylbek Kasymaliev presented the results of two key reforms in the field of digitalization of medicine and business simplification.

The first reform mentioned by the head of government concerned improving citizens' access to...

Trade brought the most taxes to the budget in the 11 months of 2025

The mining sector took second place in tax payments During the 11 months of 2025, significant...

The National Bank assessed the level of lending to the economy of Kyrgyzstan

According to the report on monetary policy, the third quarter of 2025 saw a continued increase in...

Investments in the construction of hotels and restaurants increased by 23.2% from January to November

- The report for January–November 2025 presents information that the volume of invested funds in...

Year in Review: Key Indicators of Leading Industries by Taxes

According to information provided by the State Tax Service of the Kyrgyz Republic, during the 11...

Kazakhstan's Freedom Bank to Establish a Subsidiary in Kyrgyzstan

The new structure will become part of Kyrgyzstan's banking sector, with 100% of the...

REI and Mineral Extraction Became Key Areas of FDI in Kyrgyzstan in the First Half of the Year

As of the end of the first half of 2025, Kyrgyzstan attracted $562 million in foreign direct...

The Ministry of Health of the Kyrgyz Republic and UN structures discussed pharmaceutical supply and procurement transparency.

On December 26, 2025, the Minister of Health of the Kyrgyz Republic, Kanibek Dosmambetov, held a...

In Kyrgyzstan, the coverage of preschool education for children has reached 50%

Over the past year, there has been an increase in both the number of kindergartens and the number...

The amount of fines imposed in the construction sector in 2025 has been announced

According to information provided by the Ministry of Construction, Architecture, and Housing and...

Kyrgyzstan continues to increase its national debt. How much and from whom is the country receiving?

As of October 31, Kyrgyzstan's national debt reached 8 billion 692.52 million dollars,...

Water reserves in Uzbekistan decreased by 6.5 billion cubic meters over the year

At the meeting of the Legislative Chamber of the Oliy Majlis on December 10, Minister of Water...

A representative of the Kyrgyz diaspora in Russia proposed to create a job vacancy call center and ease mortgage conditions for compatriots.

- At the IV People's Kurultai on December 26, Kubanychbek Osmonbekov, a representative of the...

Sadyr Japarov: In 2025, 4,600 families became homeowners

Today, while speaking at the People's Kurultai, the President of the Kyrgyz Republic, Sadyr...

In Bishkek, energy providers will disconnect more than 5,500 subscribers due to debts

In connection with the disconnections, the company reminds that there is a section on its website...

The livestock population in Mongolia has reached 58.1 million head.

According to preliminary census data, there are 5.1 million horses in Mongolia, which is 9.5% more...

Access to loans in the Kyrgyz Republic is set to be expanded through new amendments

A draft law has been presented to the Jogorku Kenesh concerning amendments to the existing law...

Economy on Suitcases: Why the Return of Migrants Does Not Solve Tajikistan's Problems

According to the survey results, labor migration remains an important source of income for...

Mongolia Launches the World's First 24/5 Blockchain-Based Securities Trading

With the transition to blockchain technology developed by AND Global Group, the over-the-counter...

Ministry of Labor: The official unemployment rate as of December 1 was 1.4%

According to the Ministry of Labor of the Kyrgyz Republic, the labor force of the country has...

As of December 1, 227,354 people received funds from their retirement savings.

According to information provided by the press service of the Social Fund, as of December 1, 2025,...

Kyrgyzstan Remains Among the Largest Importers of Cars from South Korea

As of November this year, the United States has become the leader in importing passenger cars from...

"Over 2 years, only 37 people have had a kidney transplant, - president"

During the People's Kurultai, President Sadyr Japarov answered a question posed by delegate...

The GNS spoke about the sectors of the economy that form the foundation of the country's budget

The State Tax Service of Kyrgyzstan has presented information on which sectors of the economy play...

In Syria, the replacement of banknotes featuring Bashar al-Assad will begin in January.

According to the statement by the head of the Central Bank of Syria, Abdelkader Khusri, the phased...

The Investigative Committee of Russia has closed the investigation into the AZAL plane crash

The Investigative Committee of Russia has announced the completion of the investigation into the...

The tariff exemption for the import of electric vehicles in Kyrgyzstan will take effect on January 22, 2026.

- As it became known, starting from January 22, 2026 , a tariff exemption for the import of...

In the Ministry of Education of the Kyrgyz Republic, they spoke about important achievements in 2025

The Ministry of Education of the Kyrgyz Republic has announced its key achievements for the year...

The Old Vehicle Fleet Intensifies Smog in Kyrgyzstan. What Have Officials Come Up With?

In Kyrgyzstan, an interdepartmental commission has been established to improve air quality. This...

Deficit in the Energy Sector. How Much Electricity Has Been Produced in Kyrgyzstan Since the Beginning of the Year

According to data from the National Statistical Committee, from January to November, Kyrgyzstan...