The global financial markets are currently in a state of historical instability: the price of gold has crossed the $5000 mark per troy ounce for the first time in history. On the Chicago Mercantile Exchange (CME), February gold futures rose by more than 2%, reaching a peak of $5091.5. According to Reuters analysts, not only gold but also other precious metals, such as silver and platinum, have also set new records. This powerful surge in precious metal prices has been driven by a sharp decline in confidence in the American economy and government assets amid escalating geopolitical conflicts. Experts note that investors are increasingly moving away from dollar-denominated assets, opting for more reliable physical investments.

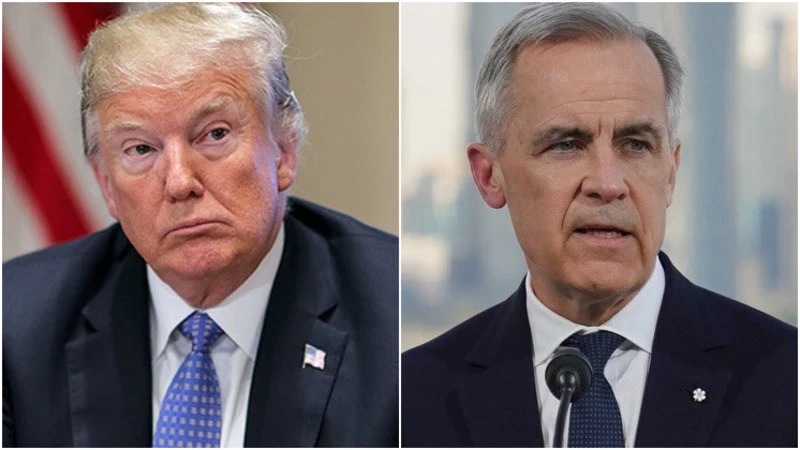

The main reason for the "gold rush" is considered to be the unpredictable foreign policy of the U.S. administration. The pace of gold price growth is striking: in 2025, it increased by 64.4%, and just in January 2026, the gain was over 17%. The sharp price increase at the beginning of the year is linked to the loud statements made by President Donald Trump. Investors were frightened by threats of imposing 100% tariffs on Canadian exports if a trade deal with China was signed, as well as the intention to impose a 200% tax on French wines. Additional factors contributing to instability include U.S. military actions in Venezuela and Trump's controversial comments about Greenland. In such conditions, gold has become the primary "safe haven" for global capital.

Financial analysts predict that gold will continue to rise. Goldman Sachs has already raised its price expectations for the current year to $5400 per ounce. Price support comes not only from private investors but also from central banks of various countries, which, as part of their de-dollarization policy, are purchasing an average of 60 tons of gold per month. If the current macroeconomic uncertainty and the Federal Reserve's accommodative monetary policy persist, the attractiveness of gold will only increase, potentially leading to a new upward revision of forecasts in the coming quarters.