During trading on January 13, March futures for Brent crude oil exceeded the $65 per barrel mark for the first time since November 18, according to data from the London ICE exchange.

Since the beginning of the year, prices have started to rise amid U.S. operations in Venezuela and concerns related to the unstable situation in Iran, which has raised fears regarding supply in the market.

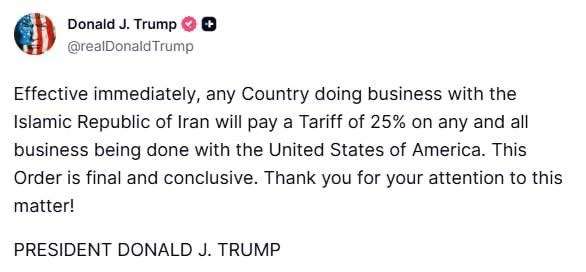

Additionally, the day before, Donald Trump, the President of the United States, announced the imposition of secondary sanctions against Iran's trading partners, including those who purchase Iranian oil. For countries caught circumventing the sanctions, the tariff on any transactions with American companies will be 25%.

Analysts also do not rule out the possibility of U.S. military intervention, which could lead to serious consequences, including potential restrictions on oil supplies from the Persian Gulf region.

Earlier, experts from Goldman Sachs, an American investment bank, predicted that by the end of 2026, the price of Brent oil could reach $54 per barrel, with an average annual price of $56. They consider geopolitical factors to be the main risks to the realization of this forecast.