QCP Capital Links Bitcoin's Rise to Maduro's Arrest

In its new analysis, QCP Capital points out that Bitcoin and Ethereum have finally broken out of the long-term sideways trend that lasted for most of December. This comes against the backdrop of significant geopolitical events in Venezuela, including the recent arrest of President Nicolás Maduro.

Breaking Barriers After Consolidation

At the beginning of the Asian trading sessions, Bitcoin rose above $92,000, while Ethereum surpassed the $3,100 mark. This movement coincided with a rise in stock indices and a drop in oil prices, triggered by actions from the United States.

QCP Capital emphasizes that the current correlation in the movements of cryptocurrencies and traditional assets may indicate a shift in trading trends. Bullish sentiment is observed at the start of the new year, especially after the end of the tax season and expectations of new cryptocurrency regulations.

The Impact of Venezuela and "Shadow" Reserves

Although many positive expectations are already reflected in prices, the shock from Washington's actions in Venezuela could serve as a short-term catalyst for Bitcoin. Additionally, rumors about potential significant cryptocurrency reserves controlled by Venezuela are being discussed again in the market.

According to market rumors, Venezuela may have substantial "shadow" Bitcoin reserves comparable to the deposits of MicroStrategy. However, analysts from QCP Capital warn that these rumors currently lack confirmation.

If this information is validated, Venezuela could become the largest sovereign holder of Bitcoin, aligning with the country's increasing reliance on cryptocurrencies across various business sectors, including the use of USDT in oil transactions starting in 2024.

Strategic Reserves and Activity in the Options Market

The prospect of including seized Bitcoins in the strategic reserves of the U.S. reduces the likelihood of their forced sale, highlighting the strategic importance of Bitcoin in the context of global competition for its accumulation.

In the options market, there is a rise in bullish sentiment. QCP Capital notes a decrease in put skew across all expiration dates and has recorded over 3,000 call option contracts with a strike price of $100,000, expiring on January 30, 2026.

The strategy of buying call options implies acquiring the right to purchase Bitcoin at a price of $100,000 by the end of January 2026. If the asset price exceeds this level, the option will become profitable. This strategy is based on expectations of asset price growth and allows for leverage with limited risk, with maximum possible losses being only the cost of the option premium.

Additionally, there is significant interest in the straddle strategy, which involves simultaneously buying call and put options with the same strike price, indicating the closing of short positions as Bitcoin rises and increasing the risk of gamma movement in the event of a continued rally.

Maintaining Caution

Despite positive signs, analysts at QCP Capital urge caution. American trading sessions continue to restrain recent gains, and this behavior requires attention until it changes.

The geopolitical situation in Venezuela creates new conditions for the cryptocurrency market, combining traditional politics and digital assets, opening previously unknown opportunities.

Artificial Intelligence Analysis

From a machine analysis perspective, the connection between geopolitical events and cryptocurrency prices often proves to be erroneous. History shows that many Bitcoin movements have been attributed to external factors post factum—from Federal Reserve decisions to military conflicts. A statistical analysis of over 100 such "explanations" over the past five years shows that in 70% of cases, the correlation disappeared within a few trading sessions.

While the macroeconomic logic regarding the disinflationary effect of oil appears convincing, it overlooks an important fact: Bitcoin historically responds weakly to changes in the consumer price index. More significant factors remain dollar liquidity and institutional flows. The hypothesis of Venezuela's "shadow reserves" resembles myths about treasures—sounds appealing but requires more serious evidence than just market rumors.

Source: hashtelegraph.com

Read also:

The price of Bitcoin has exceeded $90,000

Today, the price of Bitcoin reached $90,000, but soon retreated to $87,000, as reported by...

Against the backdrop of the arrest of the President of Venezuela, gold prices are approaching a new record.

According to Reuters, the rise in gold prices is influenced not only by the geopolitical tension...

What is known about the situation in Venezuela as of the evening of January 3rd

The situation in Venezuela has escalated amid news of a possible military operation by the U.S.,...

Bloomberg: Marco Rubio Will Take Over the Management of Venezuela After Maduro's Overthrow

According to Bloomberg sources, after the overthrow of President Nicolás Maduro, U.S. Secretary of...

Turkey and Iran condemned the actions of the USA in Venezuela

In response to the large-scale military actions by the U.S. in Venezuela, the Turkish Ministry of...

The Situation in Venezuela. The US Evacuated Nicolás Maduro and His Wife, Trump Said

According to sources from the Wall Street Journal, the U.S. military operation in Venezuela...

Trump called Maduro's takeover a warning for all who threaten the USA

During a press conference held at his Mar-a-Lago residence in Florida, U.S. President Donald Trump...

The New York Times: As a result of the U.S. operation in Venezuela, at least 40 people have died

According to information published in The New York Times, at least 40 people died as a result of a...

The USA captured and transported the President of Venezuela, Nicolás Maduro.

Maduro's wife has also been captured During a major military operation, according to...

Trump threatened Venezuela's interim president Delcy Rodriguez that she could pay "an even higher price than Maduro."

According to the President of the United States, if Delcy Rodriguez does not change her behavior,...

The Situation in Venezuela. The First Photos of Captured Nicolás Maduro Have Emerged

According to information from CNN, Nicolás Maduro and his wife have been placed in a detention...

Trump stated that the USA has captured the president of Venezuela

In his statement, Trump noted that "the United States of America conducted a successful...

Explosions Heard in the Capital of Venezuela and Power Outage Reported

In the southern part of the city, near a significant military base, there has been a power outage....

In Venezuela, posters featuring Nicolás Maduro have started to be taken down

In various corners of Venezuela, a campaign has begun to remove posters depicting Nicolás Maduro,...

Media: CIA Suggested to Trump the Best Candidates to Replace Maduro - and They Are Not from the Opposition

In a secret report presented to U.S. President Donald Trump, the CIA claims that high-profile...

Acting President of Venezuela Delcy Rodriguez published a message to the USA

The interim president of Venezuela, Delcy Rodriguez, appealed to the United States for joint...

During the kidnapping of Nicolás Maduro, most of his security was killed - Ministry of Defense

According to the statement by Venezuelan Defense Minister Vladimir Padrino López, a significant...

Martial Law Introduced in Venezuela

According to Maduro, the actions of the United States are aimed at "seizing strategically...

Delsy Rodriguez took the oath as acting president of Venezuela

Delcy Rodriguez, the acting president of Venezuela. Photo by Ariana Cubillos / AP Photo / dpa /...

In the USA, it was announced that Maduro will face an American court.

Christopher Landau, the U.S. Deputy Secretary of State, made a statement on social media platform...

Zelensky: If this is how we deal with dictators, then the USA knows what to do next

During a briefing for journalists, Ukrainian President Volodymyr Zelensky commented on the recent...

Explosions Rocked the Capital of Venezuela

On the night of Saturday, January 3, Caracas, the capital of Venezuela, became the site of a series...

The Situation in Venezuela. The First Photos of Captured Nicolás Maduro Have Emerged

According to CNN, Nicolás Maduro, the president of Venezuela, along with his wife, has been...

Trump stated that the US will manage Venezuela and threatened new strikes.

In his speech, Trump emphasized: “We are there — and we will stay until a real transfer of power...

The UN expressed concern over the situation in Venezuela and the detention of Maduro

On January 3, a sharp escalation of the conflict occurred: American troops struck targets in...

The President of Colombia proposed to hold an emergency UN meeting on the situation in Venezuela

Gustavo Petro, the president of Colombia, called for an urgent meeting of the UN and the...

The Situation in Venezuela. The Global Community's Reaction to Nicolás Maduro's Seizure of Power

Venezuela has become the center of global news attention following a military operation conducted...

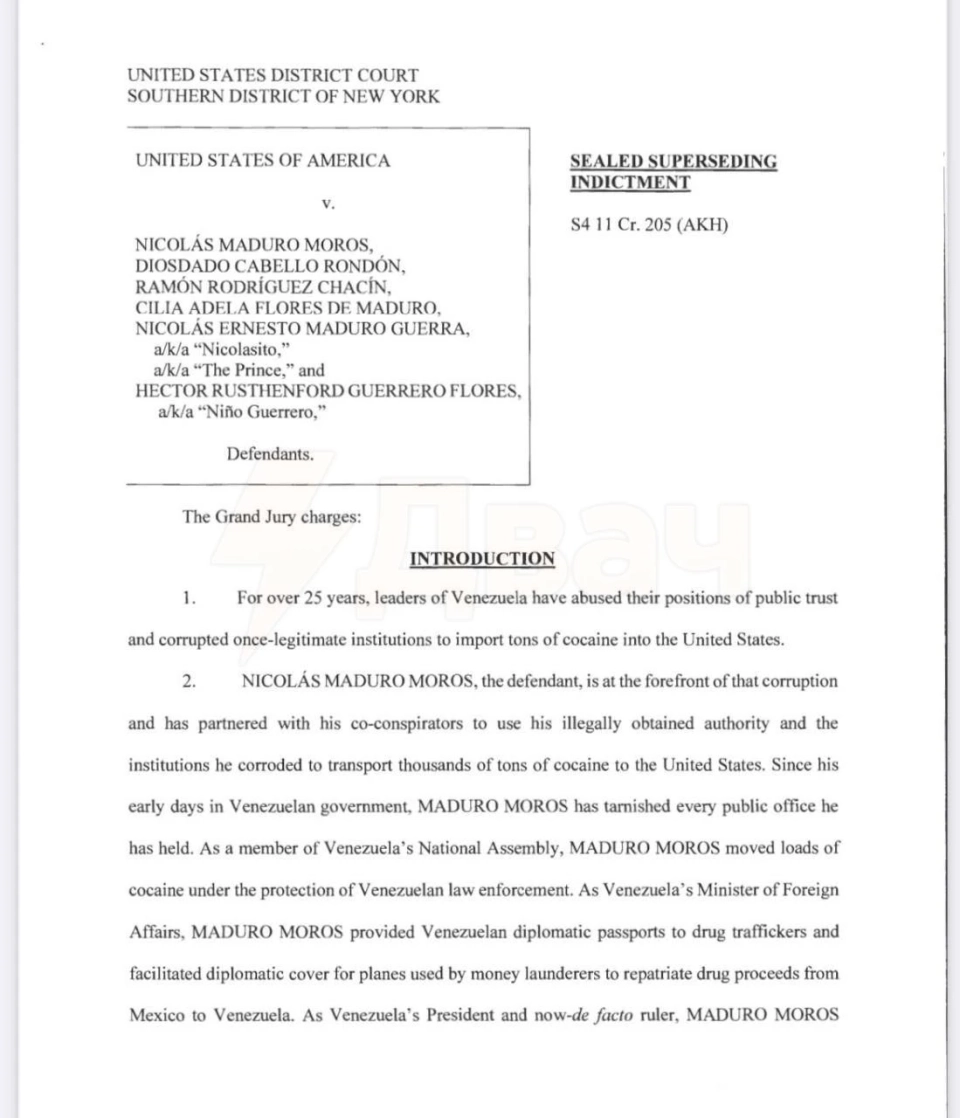

The Situation in Venezuela: The U.S. Unveils a List of Charges Against Nicolás Maduro

The situation in Venezuela continues to deteriorate following a recent military operation by the...

The leader of the Venezuelan opposition declared himself the president of the country and addressed the army.

Edmundo Gonzalez, a representative of the Venezuelan opposition, has declared himself the president...

Trump Talks About Greenland Again and Threatens the New Authorities of Venezuela

In a recent interview with The Atlantic, Donald Trump reiterated the necessity of Greenland for...

Trump reported the capture of Venezuelan President Maduro

The United States of America has carried out military aggression against Venezuela. Around seven...

The European Union made an official statement on the situation in Venezuela

On the evening of January 4, Kaja Kallas, representing the European Union, called for respect for...

Nicholas Maduro's Lawyer is the Defender Who Freed Julian Assange

The first hearings in the case of Nicolás Maduro, the former president of Venezuela, took place on...

Six countries stated that the USA has created an "extremely dangerous precedent" in Venezuela

Six countries, including Brazil, Chile, Colombia, Mexico, Uruguay, and Spain, have expressed...

Trump refused to support the opposition leader in Venezuela due to the Nobel Prize

Donald Trump refused to support Maria Corina Machado, the leader of the Venezuelan opposition, due...

Did Trump Exchange Taiwan and Ukraine for Venezuela?

Analyzing recent events, Jaykhun Ashirov reflects on why the theory of a conspiracy between the...

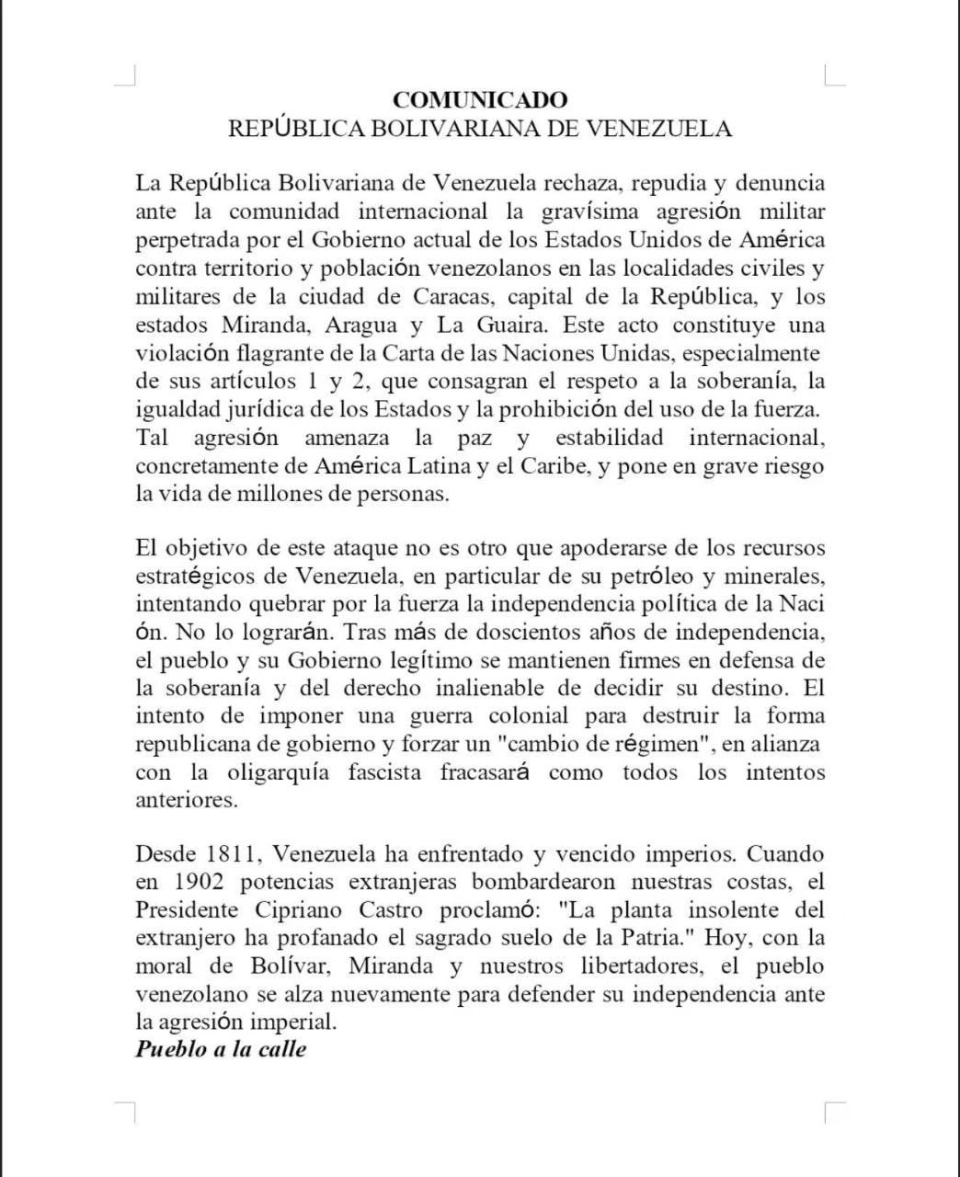

The Situation in Venezuela. A State of Emergency Declared in the Country After the US Attack

After the military attack by the USA on Venezuelan military facilities, the country's...

Operation of the USA in Venezuela: the world calls for de-escalation

As a result of the military operation conducted by the United States in Venezuela on January 3,...

Vice President of Venezuela Delcy Rodriguez Appointed Acting President

Archive photo of Delcy Rodriguez from EFE Delcy Rodriguez has taken the position of acting...

Delsy Rodriguez Appointed Acting President of Venezuela

In accordance with the court's ruling, Delcy Rodriguez will temporarily lead Venezuela with...

President Maduro Captured by American Troops. Trump States that the U.S. "Will Govern" Venezuela and "Reconstruct the Oil Infrastructure"

U.S. President Donald Trump announced that his country will "manage" Venezuela until a...

The Situation in Venezuela. The US Intends to Control the Country and Other Statements by Trump

U.S. President Donald Trump stated at a press conference his intention for Washington to manage...

Shamans predicted Trump's illness, Maduro's exile, and the end of the war in Ukraine in 2026

Peruvian shamans during a ritual on the beach in Lima. Photo AFP. On December 29, Peruvian shamans...

Currency Forecast. How Much Will the Dollar, Euro, Tenge, and Ruble Cost in 2026

In recent years, the exchange rate of the Kyrgyz som has demonstrated relative stability. Although...

Why the U.S. Supreme Court Will Be Forced to Release Nicolás Maduro?

The trial against Nicolás Maduro and his wife Cilia Flores in the United States has become a...

What is known about the capture of Nicolás Maduro and the US operation in Venezuela as of January 4?

On the night of January 2-3, the United States carried out a military operation in Venezuela,...

The USA Strikes Venezuela. Official Caracas Declares Military Aggression

According to information provided by American sources to CBS News, U.S. President Donald Trump has...

The Supreme Court of Venezuela appointed Delcy Rodríguez as acting president of the country.

The Constitutional Chamber's decisions led the Supreme Court of Venezuela to appoint Delcy...