The price of gold has exceeded $5000 per ounce for the first time, - Bloomberg

Over the past two years, the value of gold has more than doubled. This is related to the so-called "devaluation trading," where investors begin to avoid currencies and treasury bonds. Since the beginning of the current year, the price of gold has increased by more than 17%. Recent sell-offs in the Japanese bond market demonstrate how investors are starting to turn away from large government expenditures.

The price of gold has risen by about 2%, reaching $5085, which is linked to the weakening of the dollar, in turn increasing demand for the metal. The U.S. dollar index has decreased by nearly 2% over the last six trading days, and the possibility that the U.S. may assist Japan in strengthening the yen raises concerns about the independence of the Federal Reserve and Trump's unstable policies.

The recent rise in precious metal prices is also driven by purchases from central banks and increased demand for these assets as safe havens.

Silver has also shown significant growth, increasing by more than 5% and reaching a record above $100 per ounce due to high demand from retail buyers in cities like Shanghai and Istanbul.

“Recent actions by the Trump administration — criticism of the Fed, the threat of annexing Greenland, and military intervention in Venezuela — have caused panic in the markets. For investors seeking to cope with this uncertainty, gold as a safe-haven asset has become particularly attractive,” Bloomberg reports.

Over the weekend, Trump threatened Canada with 100% tariffs on all exports to the U.S. if Ottawa strikes a trade deal with China, escalating tensions in bilateral relations. Political uncertainty in the U.S. also persists, as Senate Democratic leader Chuck Schumer has promised to block a major budget package if Republicans do not abandon funding for the Department of Homeland Security, increasing the likelihood of a partial government shutdown.

The rising national debt in developed countries is also becoming an important factor contributing to the rise in gold prices. Some long-term investors, confident that only inflation can lead to financial stability, are actively buying gold to protect their purchasing power.

“Most geopolitical uncertainties caused by Trump's actions are unlikely to be resolved anytime soon,” noted Vasu Menon, managing director of investment strategy at Oversea-Chinese Banking Corp Ltd. This suggests that “gold will remain attractive for investment in the coming months and even years, although investors should be prepared for periodic corrections after significant growth over the past year.”

Read also:

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

What the Labor Market in Kyrgyzstan Was Like in 2025: Salaries, Job Vacancies, Regional Rankings

The labor market is a reflection of social and economic processes, and analysts from the platform...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

Franc strengthens amid economic crisis and outpaces other currencies

The decline of the dollar has turned out to be one of the most significant events in finance in...

To Avoid Inflation and Preserve Value: What Should Investors in Bishkek Do?

In the context of global economic instability and the resurgence of inflation, the period from...

In the U.S., an investigation has been launched against Federal Reserve Chairman Jerome Powell

According to information voiced by Powell, a criminal investigation against him has been initiated...

The White House stated that the U.S. is discussing options for acquiring Greenland, including the use of military means.

Last weekend, Trump stated that the United States "needs" Greenland for security...

Gold prices hit a record high amid two factors

On the night of Monday, January 12, the price of a troy ounce of gold approached the mark of 4600...

Exchange prices for gold and silver have broken historical records

Record prices for gold and silver have been recorded on the commodity exchange, surpassing $4,600...

Trump stated that the U.S. should "own" Greenland to prevent its takeover by Russia and China.

Donald Trump, the President of the United States, emphasized that the United States must...

Prices for gold, silver, copper, and tin have reached historical highs

Photo from the internet. Historic price records for gold, silver, copper, and tin Amid rising...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Did Trump Exchange Taiwan and Ukraine for Venezuela?

Analyzing recent events, Jaykhun Ashirov reflects on why the theory of a conspiracy between the...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The New York Times: The Melting of Greenland's Ice Has Climate, Economic, and Geopolitical Consequences for the Entire World

The situation in Greenland affects the interests of billions of people around the world. The...

Nostradamus' Prophecies for 2026: King Donald Trump, the Decline of the West, Widespread War, and AI

As 2026 approaches, interest in Nostradamus' "Prophecies" — the famous collection...

The President of France stated that "the USA is gradually turning away from its allies"

On Wednesday, Donald Trump, the President of the United States, mocked French leader Emmanuel...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

Sale of the former Prince Andrew's mansion to Kazakh oligarch Kuliayev for £15 million is linked to a bribery scheme, - BBC investigation

A BBC investigation has revealed that Andrew Mountbatten-Windsor received significant sums from an...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

Venezuela, Iran, Greenland: Goals Without Brakes. Western Media on Trump's Course

Photo from the internet. Donald Trump The beginning of 2026 for the 47th President of the United...

The President commented on the replacement of indefinite driver's licenses and named the reasons for the initiative.

The discussion about the replacement of indefinite driver's licenses has caused a wide public...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

The President of Chile is José Antonio Kast, a supporter of dictator Pinochet

José Antonio Kast, representing the far-right political force, has been elected as the President...

The exchange price of gold has surpassed $5,000 per troy ounce for the first time.

On the Comex exchange, the price of gold futures has surpassed the $5,000 mark for the first time...

Merz Limited Himself to Vague Guarantees for Ukraine at the Meeting in Paris

At the summit of the "coalition of the willing" in Paris, Chancellor Friedrich Merz...

Seven European countries sent troops to Greenland. The White House stated that this will not affect Trump's plans.

Seven European countries have sent their military personnel to Greenland as part of an...

Russian and Ukrainian Drone Manufacturers Buy Components from the Same Chinese Companies

According to The Financial Times, Russian and Ukrainian drone manufacturers are using the same...

Foreign Workers, Local Sponsors: How Cyber Fraud Schemes with Hotels in Palau Are Organized

New data reveals the mechanisms of operation of two alleged fraudulent centers in Palau, a small...

Canada fears it may become Trump's next target after Venezuela and Greenland

Canada expresses concerns that it may become the next target for Donald Trump's presidential...

WMO confirms that 2025 was one of the warmest years on record

The WMO has confirmed that 2025 was among the three warmest years, continuing the trend of...

The market price of gold has reached a new record.

An historic event has occurred on the exchange: the price of gold has exceeded 4,800 dollars per...

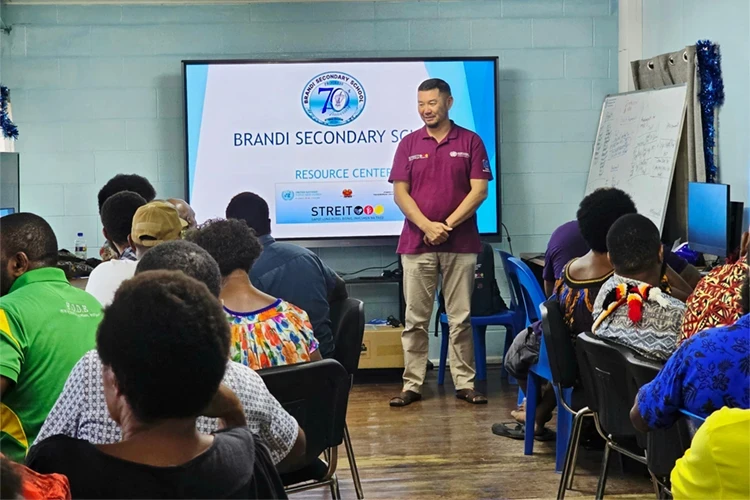

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

How Crypto Miners Stole $700 Million from People, Often Using Old Proven Methods

The theft of cryptocurrency evokes a particular, agonizing feeling. All transactions are recorded...

Stable, Pragmatic, and Gradually Developing Relations - Ambassador of Kazakhstan Rapil Zhoshybaev (Interview)

The Extraordinary and Plenipotentiary Ambassador of Kazakhstan to Kyrgyzstan, Rapil Zhoshybaev,...

Life in the Regions: A Bullet in the Seat of a Honda — How One Detail Helped Investigator Kurmanbek Kanybek Uulu from Osh Uncover an Organized Crime Group

Kurmanbek Kanybek uulu — an investigator of the control and methodological department of the...

Trump wants "immediate negotiations" on the acquisition of Greenland, but insists that "he will not use force"

Trump concluded his speech after access issues arose in the hall. Security measures were at the...

The Abduction of Maduro: Hugo Chavez Already Predicted the Approach of This Operation

Tarik Ali reports that Chavez anticipated such actions when he was told that he might be accused...

USA and UK Withdraw Part of Personnel from Military Base in Qatar. Iran's Air Defense on High Alert

The American and British troops at Al Udeid base are facing potential threats, leading to the...

Embassy of Iran: No country will tolerate riots and arson

The Embassy of the Islamic Republic of Iran in the Kyrgyz Republic has published a statement...

Nelly Nosalik: Advertising on Social Media - The Most Promising Direction

In Kyrgyzstan, there is a growing interest in women's entrepreneurship in the field of...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Is Kazakhstan Awaiting a Water Collapse Following the Iranian Scenario?

The inability of the new Ministry of Water Resources to address the water shortage problem is...