In a Bishkek café, shadow accounting and hidden revenue of 12 million soms were uncovered

According to information from the State Tax Service (STS), three establishments owned by a single owner were using unregistered programs for shadow accounting. This resulted in a significant portion of revenue not being reflected in official reports. It was also discovered that employees were accepting payments through QR codes registered to private individuals, which is against the law.

During the inspection, cash was found in the café registers, but without fiscal receipts confirming their legality. The estimated volume of hidden revenue amounted to about 12 million soms, while the amount of unpaid taxes was around 648 thousand soms.

Tax authorities emphasize that concealing income and maintaining double accounting are criminal offenses, which may lead to both administrative and criminal sanctions. The verification work is ongoing.

Read also:

Driver reform, words of Zhapikeev, visas, prices, GIC. What was January 2026 like?

January 2026 became particularly lengthy for the residents of Kyrgyzstan. It seems that not days,...

"Ay-Pery" has transformed into an international business center — photo report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In Kyrgyzstan, they want to launch a climate education program by 2030.

The Ministry of Science, Higher Education and Innovations of the Kyrgyz Republic has initiated...

Torture of Patients. The GKNB Reveals Shocking Rehabilitation Methods at the "Path to Life" Center

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Kamchybek Tashiev opened a new sports complex in Bishkek

Curl error: Operation timed out after 120000 milliseconds with 0 bytes received...

Casino Only for Foreigners: Kazakhstan Tries to Repeat the Singapore Trick

Kazakhstan is striving to replicate Singapore's successful experience in creating gambling...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Ombudsman checked the conditions of detention in women's colony No. 2

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Cases of revenue concealment identified in Bishkek cafes

In the capital of Kyrgyzstan, Bishkek, the State Tax Service conducted a series of inspections at...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the State Committee for National Security of the Kyrgyz...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the chairman of the GKNB, Kamchybek Tashiev, visited a specialized school...

Russian and Ukrainian Drone Manufacturers Buy Components from the Same Chinese Companies

According to The Financial Times, Russian and Ukrainian drone manufacturers are using the same...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

A Major Loan Shark and Owner of a Pawnshop Chain Arrested

In Bishkek, law enforcement agencies detained a well-known loan shark and owner of a chain of...

Foreign Workers, Local Sponsors: How Cyber Fraud Schemes with Hotels in Palau Are Organized

New data reveals the mechanisms of operation of two alleged fraudulent centers in Palau, a small...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

Cells, Humans, and AI Think Alike — A Group of Scientists Discovered a Common Algorithm

What do a developing embryo, an ant colony, and the latest version of ChatGPT have in common? At...

In Bishkek, the sports event "Winter Festival - 2026" took place.

A sports event for children called "Kyshty Mayram - 2026" took place today, January 31,...

In Batken, children were shown a New Year's fairy tale and received gifts from the regional leadership.

In Batken, a New Year's celebration for children was held, organized by the presidential...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

Xi Jinping is conducting purges in the general staff. What does this mean for China and its neighbors, including Central Asia?

Over the weekend, General Zhang Youxia, who held the position of Vice Chairman of the Central...

The Nomadic World Will Gather in Kyrgyzstan. What to Expect at the VI WMC: Innovations and Program

From August 31 to September 6, 2026, Kyrgyzstan will host the VI World Nomad Games (WNG). At a...

The sister of Chinghiz Aitmatov addressed the people of Kyrgyzstan (text of the address)

In her address, Roza Torokulovna touches on the topic of malicious rumors and accusations that are...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Laboratory Study: The Myth that Boxing Caused Muhammad Ali's Parkinson's Disease

The question of whether boxing caused Muhammad Ali's Parkinson's disease sparks heated...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

In Bishkek, the organization of closed private parties for adults has been shut down.

In Bishkek, an organization conducting closed private parties for adults was identified, according...

The Minister of Health congratulated children in medical institutions across the country

On December 30, 2025, the Minister of Health of the Kyrgyz Republic, Kanbek Dosmambetov, visited...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Minister of Health of the Kyrgyz Republic congratulated children in medical institutions across the country

On December 30, 2025, the Minister of Health of the Kyrgyz Republic, Kanibek Dosmambetov, visited...

Employees of weight and dimension control detained for extorting money from drivers

As a result of operational measures, seven employees of the weight and dimension control on the...

Sale of the former Prince Andrew's mansion to Kazakh oligarch Kuliayev for £15 million is linked to a bribery scheme, - BBC investigation

A BBC investigation has revealed that Andrew Mountbatten-Windsor received significant sums from an...

Apartments for Champions: Tashiev Rewarded Six Athletes for Their Achievements on the World Stage

On December 25, the Deputy Prime Minister and head of the State National Security Committee,...

Kamchybek Tashiev handed over 34 vehicles to the Motherhood and Childhood Protection Center

On January 1, in the Jalal-Abad region, 34 cars were handed over to the employees of the National...

A sketch for the improvement of the area around the Burana Tower has been developed

The Ministry of Construction reported that architects from the Department of Urban Planning and...

US sanctions kill half a million people a year worldwide

In a study conducted by scientists from the University of Denver and the Center for Economic...

In Batken Region, winners of the "Altyn Örük" award have been selected

Recently, an award ceremony for the winners of the "Altyn Örük" award took place in the...

The President of Chile is José Antonio Kast, a supporter of dictator Pinochet

José Antonio Kast, representing the far-right political force, has been elected as the President...

Rest in Goa: A Guide for Kyrgyzstanis on the Main Tourist Destination in India

Goa is one of the most vibrant and attractive tourist regions in India. Here, everyone will find...

Winter Bird Count Conducted at Lake Issyk-Kul and Orto-Tokoy Reservoir (Photo Report)

During the winter period, a count of waterfowl and wetland birds took place at Lake Issyk-Kul and...

The Tax Service Presented New Year Gifts to Social Institutions Across the Country

In anticipation of the New Year holidays, employees of the State Tax Service organized an event to...

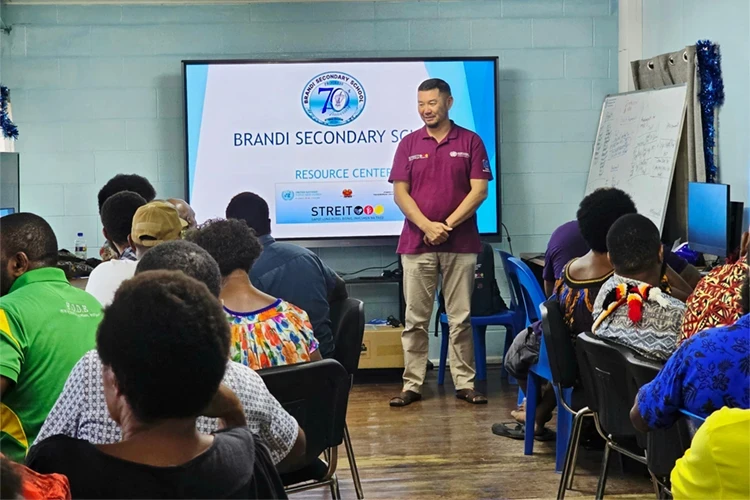

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

New Year Show at the Circus for Children from Vulnerable Categories

In Bishkek, on December 25, a New Year celebration for children from rehabilitation centers, as...

A new prosecutor's office building opened in the Alai District

The opening of a new administrative building of the prosecutor's office took place in the...