New Benefits Will Be Provided for the Sewing and Textile Industry

According to the new regulations, starting from January 1, 2026, entrepreneurs in this industry will pay an insurance contribution of 12% of 40% of the average monthly salary for each employee, which amounts to 2,115.5 soms. Additionally, the income tax will be 1% of the average monthly salary, equal to 440.7 soms. Thus, the total amount of mandatory payments for one employee will be 2,556.2 soms.

It is important to note that in 2026, the average monthly salary is set at 44,070 soms.

These changes are being implemented to support local producers, reduce the tax burden, improve tax administration, and create more favorable conditions for production development. They are also aimed at enhancing the competitiveness of products in both domestic and foreign markets, as well as stimulating employment and increasing the export potential of the sector.

Read also:

New Benefits for the Sewing and Textile Industry Have Emerged

According to the State Tax Service of the Kyrgyz Republic, in accordance with the Law of the Kyrgyz...

The sewing industry is transitioning to preferential taxation until 2030

Starting from January 1, 2030, new tax conditions will apply to the sewing and textile industries....

Tax benefits enhance the competitiveness of the textile industry and trigger a cumulative effect, - board member of the "Legprom" association

The president has signed a new law that introduces tax benefits for various entrepreneurs, as well...

Tax benefits for businesses and citizens are being introduced in Kyrgyzstan

Sadyr Japarov signed the Law of the Kyrgyz Republic "On Amendments to Certain Legislative Acts...

Business Support: Taxes Reduced and Certain Licenses Abolished

President Sadyr Japarov has approved a draft law that amends various legislative acts related to...

In Kyrgyzstan, excise tax rates on alcohol will increase starting in 2026

Starting from January 1, 2026, new excise tax rates on alcohol will come into effect in Kyrgyzstan....

A bill providing tax benefits for certain sectors of the economy has been adopted by the Jogorku Kenesh.

The draft law includes a number of measures aimed at the comprehensive development of the jewelry...

Tax and Insurance Reliefs for Businesses Introduced in Kyrgyzstan

According to the press secretary of the president, Askhat Alagozov, the head of state has signed a...

In Kyrgyzstan, excise tax rates on alcoholic products have been increased

Starting from January 1, 2026, it is planned to increase the excise tax rates on alcohol in...

Good news for Kyrgyz citizens. Changes have been made to the tax laws.

President Sadyr Japarov has signed a new law concerning amendments to the legislation of the Kyrgyz...

The President signed a law on tax and administrative benefits for businesses and citizens

The document includes the cancellation and reduction of several taxes, as well as new rules in...

The Wallet of Kyrgyzstan Residents in 2026: Who Will See Increases in Income and Expenses

Source: Internet In 2026, significant changes are expected in the financial situation of citizens...

The National Statistics Committee calculated the average salary of Kyrgyz citizens for 2025

According to the National Statistical Committee, from January to October 2025, the average income...

Exchange Rate: Banks Sell the Dollar for 87.8 Som

- As of the morning of January 12, 2026, the exchange rate of the US dollar in the banks of...

The GNS announced that for the first time in the history of independent Kyrgyzstan, it has prematurely fulfilled the plan for tax and payment collection.

The State Tax Service has successfully completed the approved plan for tax and payment collection...

Currency Forecast. How Much Will the Dollar, Euro, Tenge, and Ruble Cost in 2026

In recent years, the exchange rate of the Kyrgyz som has demonstrated relative stability. Although...

The textile industry of Uzbekistan will receive $200 million in concessional loans.

As part of this program, textile enterprises in Uzbekistan will be able to access $200 million in...

The dollar will cost an average of 94 rubles in 2026 (EAEU forecast)

- According to the Eurasian Development Bank, the average annual exchange rate of the ruble against...

Food production in Kyrgyzstan increased by more than 20% in the 11 months of 2025

- In January-November 2025, the volume of food production in Kyrgyzstan reached 66.7 billion soms,...

In a year, the GNS provided services to more than 1.1 million taxpayers

In the course of 11 months of 2025, the State Tax Service (STS) provided services to more than 1.1...

Exchange Rate: How Much Does the US Dollar Cost?

- As of the morning of December 26, 2025, the exchange rate of the US dollar in the banks of...

The law on amendments to taxes, social insurance, and non-tax revenues has been adopted. What will change?

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a law concerning changes in the...

The State Tax Service Exceeded the Revenue Plan This Year

At a departmental meeting, Almambet Shykmamatov summarized the work done over the year...

The Cabinet will create a working group for the diversification of production at the plant in Mailuu-Suu

- An off-site meeting was held in the Jalal-Abad region dedicated to the issues of the Open...

Exchange Rate: Banks Sell the Dollar for 87.6-87.8 Soms

- As of the morning of December 29, 2025, the exchange rate of the US dollar in the banks of...

How Much Meat Prices Have Increased in Kyrgyzstan Over the Year. Official Data

According to information as of January 9, 2023, the average price per kilogram of beef in...

Against the backdrop of the arrest of the President of Venezuela, gold prices are approaching a new record.

According to Reuters, the rise in gold prices is influenced not only by the geopolitical tension...

In Kyrgyzstan, mineral resources worth 65.4 billion soms were extracted in the first 11 months of 2025.

- According to statistics, from January to November 2025, the volume of industrial production in...

The Jogorku Kenesh approved the Social Fund budget for 2026 and the planned period.

- On December 25, during a meeting of the Jogorku Kenesh, parliamentarians reviewed and adopted the...

Salaries, retirement age, and new fines. What else will change in the KR in 2026

Starting from January 1, 2026, a comprehensive set of new laws will come into effect in Kyrgyzstan....

In Kyrgyzstan, the excise tax rate on alcohol has been increased (number)

Starting from January 1, 2026, an increase in the excise tax on alcoholic products will come into...

In the city of Manas, starting from 2026, tariffs for drinking water and wastewater services will increase.

Starting from 2026, water and sewage tariffs in Manas will increase, as approved at the city...

After the cancellation of the service fee, dishes in the cafe have increased in price by 20 percent

In some cafes in Kyrgyzstan, there has been a 20% increase in the prices of dishes after the...

In Kyrgyzstan, the share of imported flour has decreased due to import substitution and the fiscalization of supplies, - Association of Millers

Currently, Kyrgyzstan is experiencing significant import substitution in the milling industry. In...

More than 1 billion soms is allocated for pension increases in 2026

In 2026, a 7% increase in pensions is expected in Kyrgyzstan. This was reported by the chairman of...

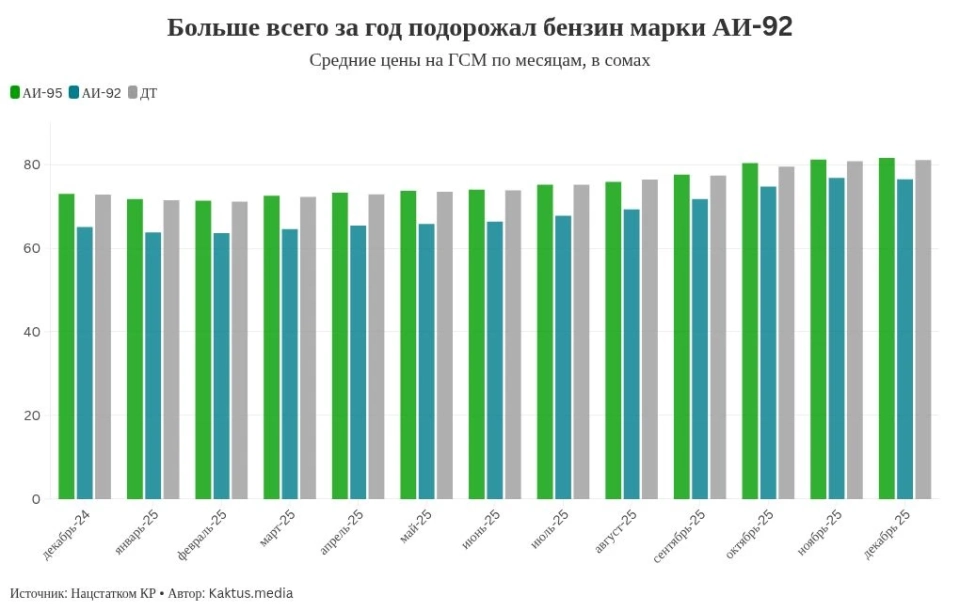

In a year, AI-92 gasoline has increased in price by 11.4 soms.

According to data from the National Statistical Committee, in 2025, the price of AI-92 gasoline...

Mongolia is Preparing for a Major Tax Reform

The presentation of the tax reform package took place in parliament. At its last meeting, the...

In Kyrgyzstan, 63 agricultural enterprises will be established in 2025

In 2025, 63 new facilities were put into operation in Kyrgyzstan as part of the agricultural...

Enterprises of the textile industry produced goods worth 18.7 billion soms from January to November 2025.

In November 2025, the production of clothing in Kyrgyzstan was recorded at 2.03 billion soms,...

High Growth Recorded in the Processing Industry Over 11 Months

During the specified period, the production volume in the processing industry amounted to 94...

Re-registration of Individual Entrepreneurs now takes up to 10 minutes

Recently, the tax service of Kyrgyzstan launched a new online service for the re-registration of...

In Kyrgyzstan, fixed airfare rates will be introduced starting in 2026.

- The new tariffs for domestic flights will come into effect on January 4, 2026. This was announced...

By number 1221 and on the Ministry of Labor portal, you can find information about job vacancies

Starting from 2026, entrepreneurs in Kyrgyzstan will have the opportunity to post information about...

New Tax Measures Will Help Develop the Automotive Industry, Legalize Income, and Support Construction, - Economist

- As part of the new package of stimulating measures recently adopted, tax exemptions for legal...

In the first 11 months of 2025, the growth of the processing industry reached nearly 28%

According to information provided by the press service of the Ministry of Agriculture, there has...

In 2025, a loan of $25 million was allocated in Kyrgyzstan to stabilize fuel prices.

- In 2025, a decision was made to allocate a loan of 25 million dollars to ensure price stability...

Textile production in Kyrgyzstan reached 3.3 billion soms by the end of November 2025

- According to statistical data, in November 2025, the volume of textile production amounted to...

Workers of the Mailuu-Suu Plant will be temporarily sent on unpaid leave. A special group will address the company's issues.

During the meeting, the current state of the enterprise, the volume of produced goods, employee...