Trust in financial markets is becoming increasingly relevant as investors seek reliable partners. How can one determine whether to trust those who offer their services, advice, or signals? This article presents an analytical overview of the key signs to pay attention to.

Defining a Reliable Trader

The term "reliable" implies that a trader or group of traders possesses the following qualities:

- The ability to demonstrate stable results in various market conditions—whether during declines, growth, or high volatility;

- Providing open information about risks and potential losses, rather than just promises of high returns;

- Working with understandable tools and strategies, avoiding complex schemes that are hard to explain in simple terms.

A combination of experience, transparency, and accountability builds trust in the trader.

Criteria for Assessing Reliability

1. Evidence and Work History

A key sign of reliability is real examples: reports, statistics, and trade journals. If a trader regularly shares their trading activity, indicating all results (both losses and profits), this is a strong argument in their favor. Formats can vary: charts, screenshots, videos. The main thing is the credibility of the information and the absence of inflated expectations.

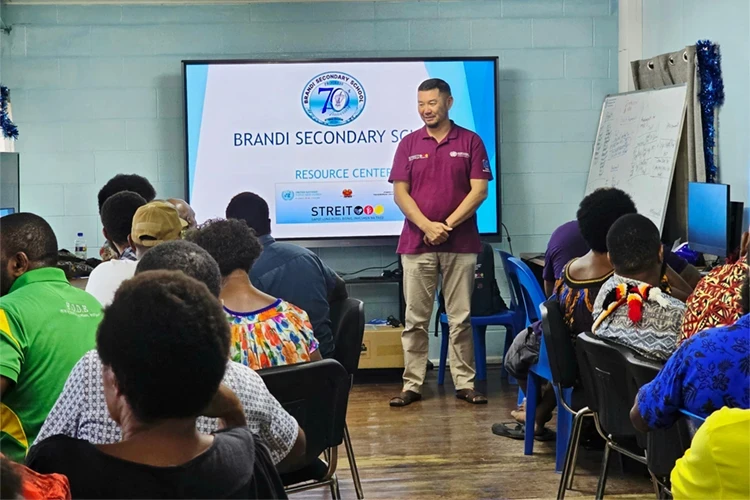

2. Transparent Approach to Education

A trader who is willing to explain their methods and share the decision-making process demonstrates the value of open relationships with the audience. They do not hide the terms of cooperation and commissions, do not exaggerate their capabilities, and do not promise easy money. Such openness is important not only for marketing but also for accountability to those who trust them.

3. Reasonable Approach to Reviews and Reputation

Online reviews can be both genuine and paid. Ideally, there should be a variety of opinions: positive reviews alternating with criticism, and the trader responds to them, analyzing and explaining their actions. If the reviews are only positive or exclusively negative, caution is warranted. It is also important how the trader handles mistakes and problems, which speaks to their accountability and adequacy.

Critical Use of Third-Party Ratings

Ratings can be useful; however, it is important to know how to analyze them:

- Consider what parameters the ratings are based on: statistics, user ratings, or built-in metrics;

- Pay attention to the period for which the rating is compiled: the last few months, a year, or just a successful short-term period?

- Compare the rating with the level of risk, as high returns are often associated with a greater likelihood of losses.

It is also helpful to study lists of filtered traders to select only those with a confirmed history and competencies.

When to Be Especially Cautious

One should be vigilant when trading promises quick income, when the popularity of passive income schemes rises, or when there are promises of easy earnings. At such times, many investors fall prey to illusions of carefree profits. It is important to apply the previously mentioned criteria: check evidence, reviews, and understand strategies.

Do not forget the psychological aspect: emotions, greed, and fear can lead to decisions that seem too good to be true. Control over one's perception is part of the investor's responsibility.

Finding a Balance Between Risk and Opportunity

Markets are always associated with risks. Even the most experienced trader cannot guarantee profit. Nevertheless, there are ways to minimize risks:

- Do not invest more than you are willing to lose;

- Diversify capital by spreading it across various instruments and strategies;

- Look at long-term prospects rather than striving for immediate gain;

- Study and analyze your mistakes.

This approach allows for a stable perception of the market as a space where there are opportunities for both successful trades and mistakes.

Trust in trading is not built instantly—it is formed from many factors: honesty, proven experience, and openness. For those looking to find partners with a solid reputation, it is useful to compare various options, rely on ratings and reviews. At the same time, it is important to remember that no rating, even one labeled "the best," can replace personal verification, for example, by consulting only verified traders and studying their practices.

Trading is not a show or instant success; it is discipline and responsibility. Those who combine skill and openness have every chance for long-term and stable work.