In Kazakhstan, the tenge exchange rate could collapse at any moment - Reuters

The situation with household incomes in Kazakhstan is deteriorating, raising serious concerns. Economic journalist John Sindry emphasizes that last year saw a rise in investor interest in securities from emerging economies, including Kazakhstan, where bonds have become attractive to non-residents.

He also warns that the influx of such carry trade-based investments could lead to destabilization of the financial situation.

Kazakhstan's bonds, denominated in tenge, offer a potential yield of 16% against an expected inflation rate of 11%, making them more attractive compared to dollar-denominated counterparts. However, investors risk facing currency volatility and changes in monetary policy, which are characteristic of carry trade.

Some countries whose bonds became popular among investors in 2025 have recently faced defaults (such as Zambia and Ghana) or have had to seek financial assistance from the IMF (like Egypt and Pakistan). Nevertheless, over the past decade, the debt market of frontier economies in national currencies has tripled, reaching one trillion dollars. In 2025, this category of assets proved to be one of the least susceptible to fluctuations, as import-dependent emerging economies cannot afford sharp currency swings and resort to active interventions.

According to experts, Ghana and Kazakhstan, which previously issued bonds in dollars and euros, have started attracting "hot money" to develop local markets.

The influx of foreign investments could lead to the strengthening of the tenge (as happened at the end of 2025 after the increase in the base rate), but it is important to remember that "hot money" can leave the market as quickly as it arrived. Analysts note that Kazakhstan, along with Pakistan and Serbia, is increasing its gold reserves as a precautionary measure.

Short-term foreign investments in national currency bonds represent an illusory source of stability and could exacerbate the crisis when investors attempt to exit the market simultaneously through limited options, John Sindry states.

Earlier, analysts warned that the sharp strengthening of the tenge at the end of 2025 could be temporary, and a mass exit of foreign investors from Kazakh securities could lead to an immediate drop in the exchange rate.

Read also:

The exchange rate of the tenge to the dollar in 2026 is projected to be 535 (macro forecast of the EDB).

- It is expected that the average annual exchange rate of the Kazakh tenge to the US dollar in 2026...

Currency Forecast. How Much Will the Dollar, Euro, Tenge, and Ruble Cost in 2026

In recent years, the exchange rate of the Kyrgyz som has demonstrated relative stability. Although...

The inflow of FDI has doubled over 5 years, increasing by $492.1 million

- According to statistical data, the volume of foreign direct investment (excluding outflow) has...

The inflow of foreign investments in the Kyrgyz Republic from January to September decreased by 18% — to $3.97 billion

- From January to September 2025, the volume of foreign investments (excluding outflows) in...

Ruble and tenge appreciated against the som, dollar depreciated. Currency exchange rates as of December 29.

Photo from the internet. The dollar's exchange rate against the som has changed for the first...

Ruble and Tenge Continue to Appreciate, Dollar is Depreciating. Exchange Rates as of December 30

Photo from the internet. The dollar is falling against the som for the first time in a long time...

Kazakhstan will cease to be an energy-deficient country in the first quarter of 2027, - Ministry of Energy of the Republic of Kazakhstan

According to information announced on January 14 by the Ministry of Energy of Kazakhstan, the...

Chinese investments in Central Asian countries reached up to $35.9 billion, - EDB

According to data presented in the report by the Eurasian Development Bank (EDB) for 2025, foreign...

UN forecasts a decrease in inflation to 3.1% and moderate global economic growth at 2.7% in 2026

- During the briefing, Shantanu Mukerji, the Director of the UN Department of Economic Analysis and...

In 2025, GDP per capita may reach 2,800 dollars.

This information was announced by Prime Minister Adylbek Kasymaliev...

The ruble and tenge have significantly depreciated, while the dollar is rising. Exchange rates as of January 13.

Photo from an online resource. The dollar has returned to values that were typical for almost all...

In Kyrgyzstan, an increase in investment volume is noted - mostly from China

According to the National Statistical Committee of the Kyrgyz Republic, the volume of foreign...

Investments from EAEU countries in China increased to $1.1 billion by mid-2025

The volume of accumulated foreign direct investments from Eurasian region countries in China...

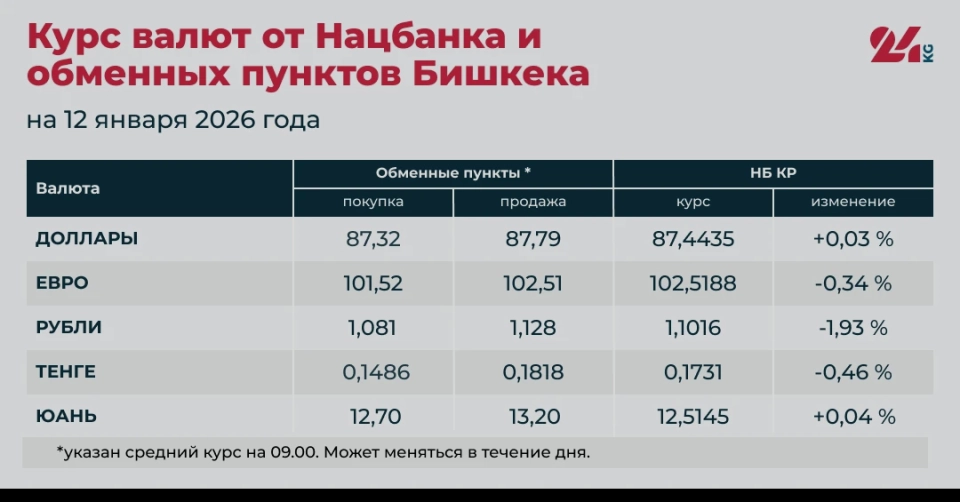

The ruble and tenge have depreciated, the dollar is rising. Exchange rates as of January 12.

According to the National Bank of Kyrgyzstan and exchange points in Bishkek, there is an increase...

Morning Currency Exchange Rates: How Much is the Dollar, Ruble, and Tenge?

- As of 8:30 AM on January 15, 2026, the exchange rate of the US dollar in the banks of Kyrgyzstan...

The global economy will grow by 2.7 percent in 2026 - UN report

According to a report by the United Nations, the global economic output is expected to grow by 2.7%...

Major investments and strong foundations will ensure growth of foreign direct investment in India in 2026

In the current year, the Department for Promotion of Industry and Internal Trade (DPIIT) organized...

China's Accumulated Investments in the Manufacturing Industry of the Eurasian Region Grew from $5 Billion to $14.5 Billion by 2025

According to analysts from the Eurasian Development Bank (EDB), the structure of Chinese...

The outflow of foreign direct investment from Kyrgyzstan increased by 1.7 times

- From January to September 2025, the outflow of foreign direct investments from Kyrgyzstan to...

Ruble, Tenge, and Euro Have Decreased Against the Som. Currency Rates on December 26

Photo from the internet. The Chinese yuan has set a new record for value this year. According to...

Kyrgyzstan is considering long-term visas for 20–30 years for investors willing to invest $300–400 thousand, - NAI

Kyrgyzstan is taking steps to create an attractive environment for investors. This became known on...

The outflow of foreign investments from Kyrgyzstan increased by 1.9 times over 9 months, reaching $403.2 million

- According to the National Statistical Committee, from January to September 2025, Kyrgyzstan...

Did Not Understand the Art. Authorities in the Kazakh Stepnogorsk Removed Snow Sculptures

Photo from the internet In Stepnogorsk, located in Kazakhstan, the snow compositions set up in the...

China's Accumulated Investments in the Eurasian Region Reached $66.1 Billion by Mid-2025

- According to data presented by the EDB, the volume of Chinese investments in the Eurasian region...

The ruble and euro have depreciated, while the dollar has started to appreciate. Exchange rates as of December 31.

Photo from the internet. The dollar has begun to recover its positions after a recent decline...

Investors in Kyrgyzstan may be granted visas for 30 years and tax holidays

The possibility of providing long-term visas for foreign investors for a period of 20 to 30 years...

The share of state-owned companies among investors from China in Central Asia decreased from 62% to 53%

- According to an analysis by the EDB analysts, there have been changes in the structure of Chinese...

Chinese Investors Increase Investments in the Energy Sector of Eurasian Countries

In its latest report, analysts from the Eurasian Development Bank (EDB) highlighted the sectors of...

The ruble sharply rose, while the dollar slightly decreased in value. Exchange rates for January 14.

Photo from the internet. The dollar has regained its positions from 2025, but after a day it began...

NBKR: The current account deficit will remain at 23.2% of GDP in 2025, and 21.3% in 2026.

- In its latest report on monetary policy, the NBKR presented a forecast for the balance of...

Investors in Kyrgyzstan may be granted residence permits and tax holidays

The authorities of Kyrgyzstan plan to provide the opportunity to obtain residency permits to...

Accumulated mutual investments in the CIS reached $41.6 billion by mid-2025, - Secretary General Lebedev

- The Secretary General of the CIS, Sergey Lebedev, reported a significant increase in mutual trade...

Investments in manufacturing industries increased by 1.3 times from January to November

- According to statistical data, the volume of investments in fixed assets directed towards the...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Economic growth is accompanied by a high level of inflation, - MDS

The economic situation in Kyrgyzstan shows a noticeable growth in nominal indicators; however, the...

In the first 10 months of 2025, there was an increase in agricultural production in Kazakhstan, Russia, and Kyrgyzstan.

- According to data from the Eurasian Economic Commission, from January to October 2025, there was...

The processing industry accounts for 37% of China's investment portfolio in Kyrgyzstan

- According to the EDB report, by 2025, accumulated Chinese investments in Kyrgyzstan reached $2.1...

Exchange Rate: Banks Sell the Dollar for 87.8 Som

- As of the morning of January 12, 2026, the exchange rate of the US dollar in the banks of...

The NBKR updated its medium-term forecast: GDP growth is expected to be around 9.5% in 2025, and up to 9% in 2026.

- In its monetary policy report for the third quarter of 2025, the National Bank of the Kyrgyz...

Real Estate Market Analysis: Weak Demand in Bishkek in 2025 and Forecast for 2026

- In 2025, the residential real estate market in Kyrgyzstan showed a noticeable increase in prices,...

The National Bank assessed the level of lending to the economy of Kyrgyzstan

According to the report on monetary policy, the third quarter of 2025 saw a continued increase in...

In Kazakhstan, a drought and water shortage are forecasted for 2026

On January 13, the Minister of Water Resources and Irrigation of Kazakhstan, Nurzhan Nurzhigitov,...

The Manufacturing Industry Attracts Chinese Investors in the Eurasian Region

- The EDB report (2025) emphasizes that the manufacturing industry occupies a key position among...

Import of dried leguminous vegetables from Kazakhstan increased 5 times in the first 10 months of 2025

- The import of dried legumes from Kazakhstan increased fivefold over ten months in 2025, according...

Karlson stated about the luxurious life of the Ukrainian elites at the expense of Western aid

Tucker Carlson, an American journalist and television host, sharply condemned corruption in...

In Kazakhstan, the likelihood of a carrot export ban is perceived ambiguously.

The planned three-month ban on carrot exports that the government intends to introduce may lead to...

The dollar will cost an average of 94 rubles in 2026 (EAEU forecast)

- According to the Eurasian Development Bank, the average annual exchange rate of the ruble against...

EAEU Expects Acceleration of Economies in Uzbekistan, Kazakhstan, and Kyrgyzstan

The bank presented a macroeconomic forecast for the period from 2026 to 2028 In its new...