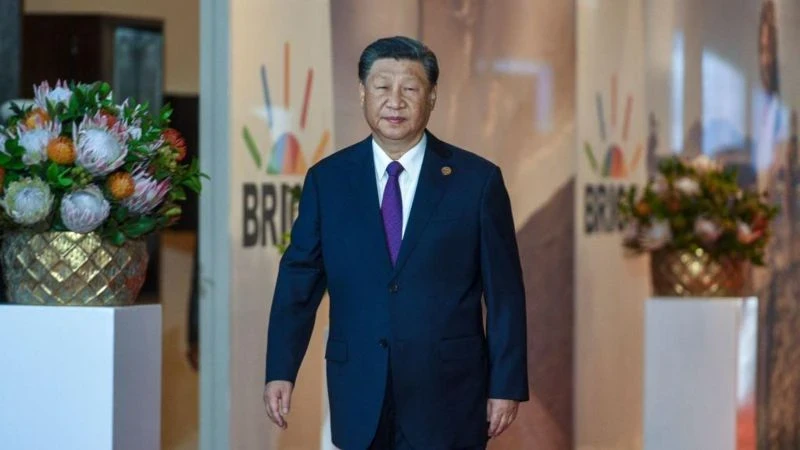

Kyrill Khomyakov, who holds the position of regional director of Binance in Central and Eastern Europe, Central Asia, and Africa, explained in an interview with 24.kg why Kyrgyzstan has become one of the main focuses for the company, what cryptocurrency is in simple terms, how to avoid fraud, and what the role of digital som is for the country.

Photo 24.kg

Reference 24.kg

Binance is the world's largest cryptocurrency ecosystem and international trading platform by trading volume of digital assets. Founded in 2017 by Changpeng Zhao (CZ), the company offers services for buying, selling, and storing cryptocurrencies and develops its own technologies for digital payments, blockchain, and Web3 infrastructure. The platform operates in over 100 countries and serves tens of millions of users.

— Explain what cryptocurrency is in simple terms so that it is understandable to a wide audience.

— Cryptocurrency is a virtual asset that operates based on blockchain technology. It can be conditionally divided into three types.

The first type is Bitcoin. It is a separate class of assets that is truly decentralized and owned by no one, and it is the largest in the world.

The second type is altcoins, which represent all other tokens. They are created by both individuals and companies, and projects can be either centralized or decentralized. Some of them have functional capabilities, while others are intended solely for entertainment. Hundreds of new tokens appear every day, but only a few survive.

The third type is stablecoins, which are virtual assets pegged to national currencies such as the dollar or euro. Their value does not fluctuate as much as Bitcoin's because they are backed by a specific currency. Roughly speaking, these are digital equivalents of money stored in a bank.

— You mention that Kyrgyzstan is one of your priorities. Why is that?

— Despite its small population and economy, Kyrgyzstan cannot compete with larger countries in terms of market size. However, its significance for us is determined not only by the market volume.

Kyrgyzstan is one of the most active and advanced examples of the implementation and support of blockchain technologies at the state level.

Some countries completely block cryptocurrencies, others regulate them, and some are just beginning to explore this area. Kyrgyzstan has already made significant progress: regulation has been implemented, new rules are being developed, and infrastructure is evolving.

We observe support from the government leadership, the functioning of the National Council under the President, the presence of a regulatory framework, and clear conditions for market participants, including users, businesses, banks, and payment companies. The recognition of technology by the state, its regulation, and assistance in implementation yield positive results.

— How can an ordinary person in Kyrgyzstan earn money with cryptocurrency?

— This is a question of education. Crypto assets are a tool for capital management, just like gold, currencies, stocks, bonds, or deposits, but with certain specifics.

The industry is still young, and the market volume is smaller than that of traditional assets, which leads to high volatility: today +5%, tomorrow -10%, the day after tomorrow +20%. This creates opportunities for high returns, but also high risks.

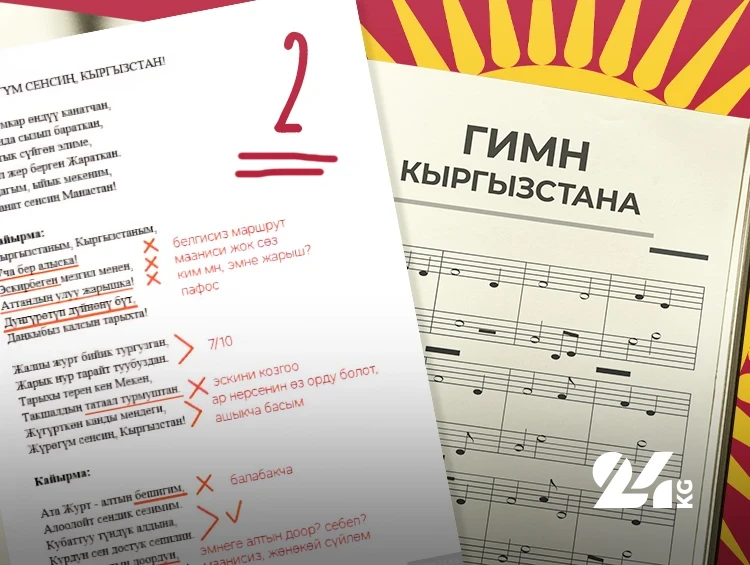

My advice to beginners: do not start with large amounts. Start with small investments while simultaneously increasing your knowledge and trying different strategies. We have a free Binance Academy, which contains a large library of materials. We have translated over 100 basic materials into Kyrgyz. Educational materials are available to everyone; you do not have to be a platform user.

— Who should get involved in cryptocurrency, and who should not?

— It is not possible to set strict limitations for users. We have a diverse audience. However, there are mandatory conditions: a person must be of legal age and go through standard identification, just like in a bank.

Most users in Kyrgyzstan are aged between 18 and 35. But crypto assets are used not only for trading: they are also for storage, payments, and transactions. It all depends on the specific task.

— What are the competitive advantages of crypto assets compared to gold and stocks?

— If we look not at short time frames but at long-term prospects since the emergence of Bitcoin, it is one of the most successful assets in history. People often think they are too late. This is called FOMO — fear of missing out. However, the industry is still in its early stages of development.

Yes, in the short term, there are times when gold grows faster. But if you look over a horizon of one year or more, the return levels will be incomparable.

If you do not plan to become a trader, a reasonable approach is to acquire a quality asset and hold it long-term (holding), accepting volatility as part of the game.

— Which coin would you recommend to beginners as reliable?

— I will not name specific projects, as this is always subjective. However, there is a golden rule: DYOR — do your own research.

Spend 20–30 minutes understanding what you are buying:

- study the project's website;

- look at the team (if there is none, that is a warning sign);

- understand the business model: how the project makes money and where its real application is;

- assess the activity of the community, investors, and publicity.

These simple steps will significantly reduce the risk of encountering unscrupulous projects.

— Where does the platform's responsibility end and the user's responsibility begin?

— In most cases, attacks are directed not at the platform but at the user. We invest heavily in security, infrastructure, and protection mechanisms. However, fraudsters often use social engineering methods to trick users into giving access to their data.

Therefore, it is important to follow basic rules that will help minimize risks:

enable two-factor authentication;

do not click on unfamiliar links and do not open suspicious files;

use complex passwords and different passwords for different accounts.

We also apply risk scoring and behavioral analysis, taking into account factors such as device, geolocation, time of login, and typical transaction amounts. In case of suspicion, we request additional confirmation or temporarily block the transaction until verification.

— What is the essence of digital som and its significance for Kyrgyzstan?

— For the state, it is important to maintain the stability of the national currency and the manageability of the financial system. Digital currency can combine the advantages of blockchain with the security of traditional national currency stored in a bank.

Kyrgyzstan already has the necessary foundation: regulation, licensed platforms, and support for innovation. All of this creates an opportunity to become a regional hub.

Read more on the topic

Kyrgyzstan has issued its first national stablecoin pegged to the som

The practical advantage is fast and cheap transfers. For example, sending $10,000 from Kyrgyzstan to Brazil through traditional channels is complicated and expensive. The digital format can reduce the time to a few minutes and lower the fees.

However, the launch is just the beginning. It is also important to create an ecosystem: integration with banks, convenient ways to purchase, and the development of payment scenarios.

— What concerns do you have regarding the development of the sector?

— People's mood often depends on the price of Bitcoin. When it rises, euphoria arises. When it falls by 10-30%, people start talking about "fraud" and "pyramids." These fluctuations happen regularly.

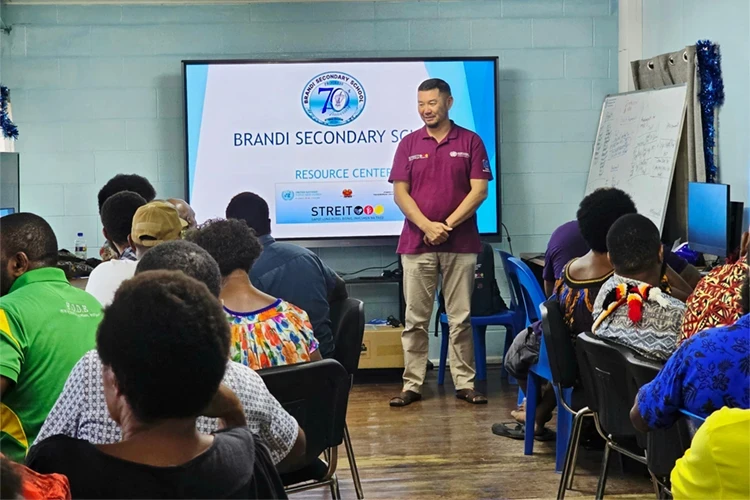

The key response to this is education. We are translating educational materials, localizing the app into Kyrgyz, and launching a university tour, planning to cover 36 universities. We will also have a local educational program manager in Kyrgyzstan.

— What algorithm of actions would you recommend to those who want to try?

— First: take basic courses. We have an educational series that explains the concept of blockchain, Bitcoin, and the basics of working with them.

Second: test your knowledge without significant investments — start with small amounts that you can afford to lose.

Third: choose a strategy — hold assets for the long term or engage in trading. Margin trading is intended only for experienced users.

It is important to continuously enhance your knowledge and keep up with industry news and product updates.

— What main myth would you like to debunk?

— The myth that cryptocurrencies are intended "for criminals" and that they cannot be traced. In fact, blockchain is transparent: the history of transactions can be verified and is accessible to anyone. The level of transparency here is higher than in the traditional financial system and much higher than with cash.