Business Opposes the Creation of a National Reinsurance Operator

In the association, it was noted that the concept proposed by the government contradicts the goals of developing the insurance sector. The business community believes that the document creates a model of excessive centralization of functions within a single state structure.

According to the IBC, the implementation of this project could lead to a decrease in competition and an increase in the industry's dependence on the decisions of a single player, which in turn could drive private insurance companies out of the market.

Moreover, experts express concern about the potential consequences of the reform for key sectors of the economy, such as energy, transport, and mining. They emphasized that a reliable reinsurance system is critically important for the stable functioning of these industries.

“Disruptions in insurance and reinsurance in these sectors could lead to project stoppages, reduced access to financing, and increased systemic risks for the economy,” they added.

The likelihood of a conflict of interest was also noted: the project proposes a combination of functions of a state insurer and a national reinsurer, which would give the government access to confidential commercial information of competitors.

As a result of the discussion, the IBC proposed to withdraw the draft resolution for a complete revision. The business community also plans to initiate changes to the presidential decree signed on March 20, 2024, with the aim of creating a balanced market model instead of an administrative monopoly.

It should be noted that the government has put forward for public discussion a draft resolution on the creation of a national reinsurer, with the "State Insurance Organization" (SIO) proposed as the operator. This project was developed in accordance with the presidential decree of March 20, 2024, No. 79, concerning the development of the insurance market.

According to the proposal, insurance companies will be required to transfer at least 10% of their risks for reinsurance to the SIO, with a possible increase of this share to 50%. The justification for the initiative states that in 2024, approximately 85% of risks are reinsured abroad. The authorities are convinced that centralizing operations will help reduce the outflow of insurance premiums and strengthen the national insurance market.

Reinsurance is a mechanism that allows insurance companies to delegate part of their responsibility to other insurers, including foreign ones. This allows for coverage of large and complex risks associated with energy, transport, mining activities, and infrastructure.

Read also:

MDS opposed the project on a national reinsurance operator

- At a recent meeting at the Service for Regulation and Supervision of the Financial Market,...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

International Business Council Demands Cancellation of National Reinsurer Project

The International Business Council (IBC) of Kyrgyzstan criticized the government's initiative...

State Insurance may be designated as the national operator for reinsurance

The Ministry of Economy and Commerce has presented for discussion a draft resolution, according to...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

What the Labor Market in Kyrgyzstan Was Like in 2025: Salaries, Job Vacancies, Regional Rankings

The labor market is a reflection of social and economic processes, and analysts from the platform...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

The National Bank of the Kyrgyz Republic presented new rules for financial marketplaces

The National Bank of the Kyrgyz Republic (NB KR) has presented a draft of new rules regarding the...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Russian and Ukrainian Drone Manufacturers Buy Components from the Same Chinese Companies

According to The Financial Times, Russian and Ukrainian drone manufacturers are using the same...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

Sale of the former Prince Andrew's mansion to Kazakh oligarch Kuliayev for £15 million is linked to a bribery scheme, - BBC investigation

A BBC investigation has revealed that Andrew Mountbatten-Windsor received significant sums from an...

"Only the political will of the president will save the architectural masterpieces of Bishkek"

The honored architect of the Kyrgyz SSR and candidate of architecture Ishenbay Kadyrbekov recently...

"War Will Change Beyond Recognition." Colonel of the General Staff of Russia — on the Lessons of Military Actions in Ukraine, Changes in the Army, and the Weapons of the Future

The conflict in Ukraine has not only become a catalyst for changes in the military sphere but has...

Foreign Workers, Local Sponsors: How Cyber Fraud Schemes with Hotels in Palau Are Organized

New data reveals the mechanisms of operation of two alleged fraudulent centers in Palau, a small...

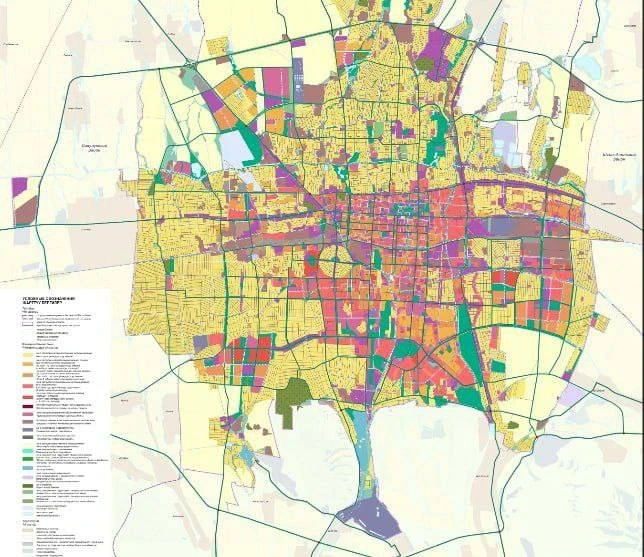

Bishkek Master Plan: Whose Homes and Lands May Be at Risk of Changes

The Bishkek City Hall presented responses to questions and suggestions from residents that were...

Did Trump Exchange Taiwan and Ukraine for Venezuela?

Analyzing recent events, Jaykhun Ashirov reflects on why the theory of a conspiracy between the...

Stable, Pragmatic, and Gradually Developing Relations - Ambassador of Kazakhstan Rapil Zhoshybaev (Interview)

The Extraordinary and Plenipotentiary Ambassador of Kazakhstan to Kyrgyzstan, Rapil Zhoshybaev,...

The President of Chile is José Antonio Kast, a supporter of dictator Pinochet

José Antonio Kast, representing the far-right political force, has been elected as the President...

Kyrgyzstan Seeks Solutions to Export Issues for Textile Products to Russia

- Since autumn 2025, the sewing enterprises of Kyrgyzstan have found themselves in a difficult...

In Kyrgyzstan, a national reinsurer is being established: the market aims to protect against fund leakage

The Cabinet of Ministers of Kyrgyzstan has presented for public discussion a draft resolution,...

What is happening with green cards? Should we expect the lottery? And what about those who have already won it?

The U.S. Green Card Lottery (Diversity Visa Lottery) has long served as one of the most accessible...

To Avoid Inflation and Preserve Value: What Should Investors in Bishkek Do?

In the context of global economic instability and the resurgence of inflation, the period from...

The Ministry of Health instructed to create a database of unscrupulous participants in the pharmaceutical market and to strengthen control over drug procurement.

The Ministry of Health of Kyrgyzstan has announced its intention to create a registry of...

Nelly Nosalik: Advertising on Social Media - The Most Promising Direction

In Kyrgyzstan, there is a growing interest in women's entrepreneurship in the field of...

Why the U.S. Should Include the Turkic States Organization in Its Policy Toward Central Asia - The National Interest

The visit of Kubanychbek Omuraliev, the Secretary General of the Organization of Turkic States, to...

Cinema as a Tool for Human Rights Protection: An Interview with Swiss Documentarian Stefan Ziegler

At the end of 2025, a ceremony for the "Ak Ilbirs" award took place at the National Opera...

UFC Fighters Coach: How Tynchtykbek Omurzakov Trains Athletes. Interview

Tynchtykbek Omurzakov is a coach who has opened the way for many mixed martial arts fighters from...

Bishkek Enters the Cycle of Revaluation of the Royal Central Park Real Estate Market and the Advantage of Price Fixation in the First Three Years

The economy, which is on the path of rapid and stable growth, leads to an increase in real estate...

A Year of Turbulence and Pragmatism. What 2025 Will Be Remembered For and What to Expect in 2026

The outgoing year 2025 was marked by significant global turbulence and a new perspective on...

Financial Nihilism: Why Young People Are More Likely to Risk Money

Against the backdrop of this financial paradox, young people who cannot afford housing are...

Is Kazakhstan Awaiting a Water Collapse Following the Iranian Scenario?

The inability of the new Ministry of Water Resources to address the water shortage problem is...

In the UK, an investigation is underway into the behavior of the chat bot Grok, created by Elon Musk, that "undresses" real people.

The UK regulator Ofcom has initiated an investigation into the platform X, owned by Elon Musk, due...

The Shadow of the Vice President of Kazakhstan: Why is the Position Being Revived Without Its Original Meaning?

Kazakhstan has already had experience with the vice-presidency, but soon abandoned it for certain...

In Bishkek, the country's water and energy security was discussed

The topic of water security in Kyrgyzstan, the resilience of mountain ecosystems, and climate...

Kyrgyzstanis Mostly Work Informally. What Reforms Could Change the Situation?

In 2025, the International Monetary Fund presented an analytical report on the state of the labor...

The Association of Flour Millers reported the need to develop domestic grain production in Kyrgyzstan.

- The pandemic has become an important signal about the necessity of creating minimum food reserves...

Trump stated that the U.S. should "own" Greenland to prevent its takeover by Russia and China.

Donald Trump, the President of the United States, emphasized that the United States must...

Zelensky, Macron, and Starmer Signed a Declaration on Guarantees for Kyiv and the Deployment of Troops in Ukraine After the Conflict Ends

During the "coalition of willing" summit in Paris, French President Emmanuel Macron,...

Alibaba's Head: China's Chances of Surpassing the U.S. in AI Are Less Than 20%

At a recent conference in Beijing, artificial intelligence experts from China presented their...

UN Report: 30 Times More Money is Spent on Destruction of Nature than on Its Protection

According to a new report from the United Nations Environment Programme (UNEP), investments...