The maximum interest rate in pawnshops is unified — 30% per annum, - Ministry of Economy

He noted that since 2018, a moratorium on checks of entrepreneurs has been in effect, which was implemented to support small and medium-sized businesses, including pawnshops.

“Even under the moratorium, there is a protective mechanism for citizens: if complaints about violations are received, the relevant authorities have the right to conduct unscheduled inspections and address specific issues,” he explained.

As of May 23, 2024, amendments have been made to the law "On the Activities of Pawnshops" concerning interest rates on loans. Every six months, the National Bank calculates the average nominal effective rate and adds 12% to it.

As of June 30, 2026, the average nominal rate was 17.17%, while the maximum allowable rate by law for all types of property reaches 29.99% per annum. This rule applies to both small assets, such as equipment and gold items, and large objects, including cars.

“Pawnshops are classified into two types depending on the type of property they work with: small or large. However, the maximum rate for both categories is the same — 30% per annum. In rural areas, rates can be significantly lower — around 2.5% per annum,” added Süyörkul Ashimjan uulu.

Read also:

The Ministry of Economic Development reminded about the ban on pawnshops accepting real estate as collateral.

- In Kyrgyzstan, pawnshops are authorized to issue short-term loans exclusively against movable...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

"Ay-Pery" has transformed into an international business center — photo report

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Bishkek Enters the Cycle of Revaluation of the Royal Central Park Real Estate Market and the Advantage of Price Fixation in the First Three Years

The economy, which is on the path of rapid and stable growth, leads to an increase in real estate...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

Recent discussions on social media and in the media have revealed that many sellers in markets...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

In 2025, approximately 1.5 million soms in fines imposed on pawnshops in Kyrgyzstan

In Kyrgyzstan, approximately 1.5 million soms in fines were imposed on pawnshop institutions in...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

Torture of Patients. The GKNB Reveals Shocking Rehabilitation Methods at the "Path to Life" Center

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Russian and Ukrainian Drone Manufacturers Buy Components from the Same Chinese Companies

According to The Financial Times, Russian and Ukrainian drone manufacturers are using the same...

The State Committee for National Security detained the owner of a pawnshop chain and displayed the collateral of clients.

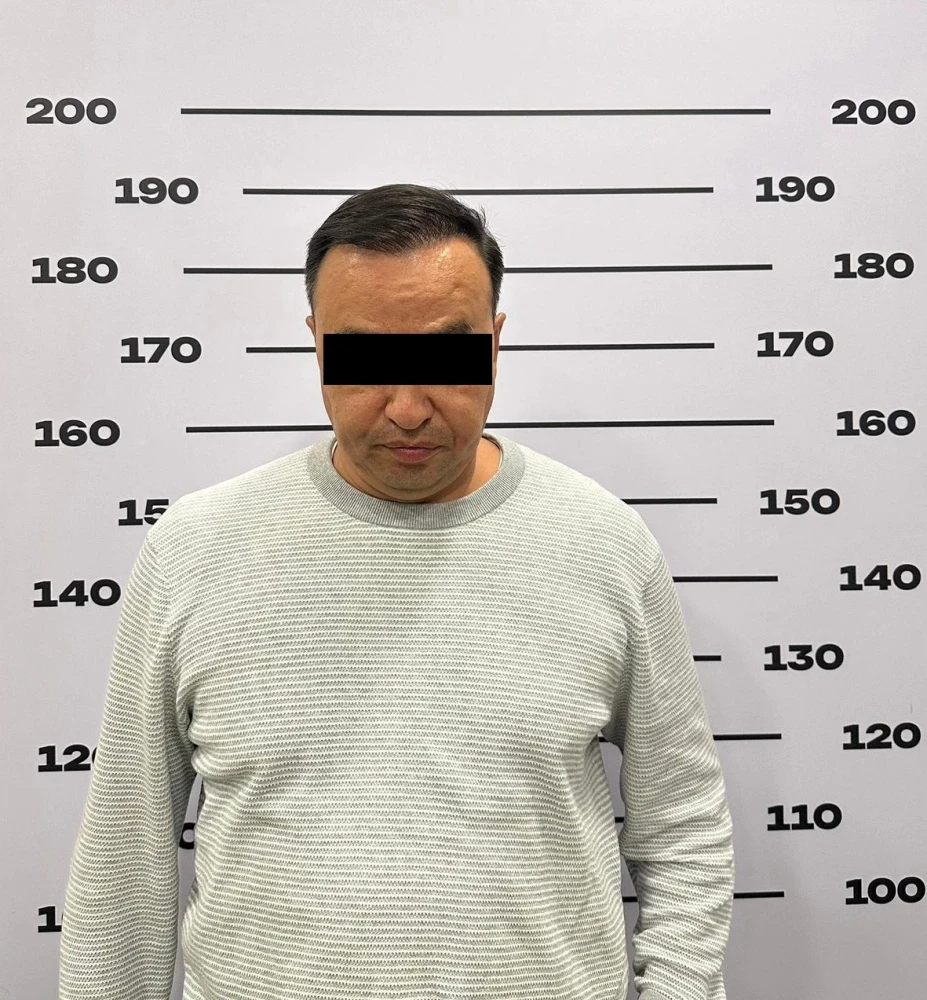

The detained suspect. Photo by the State National Security Committee. According to the press...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

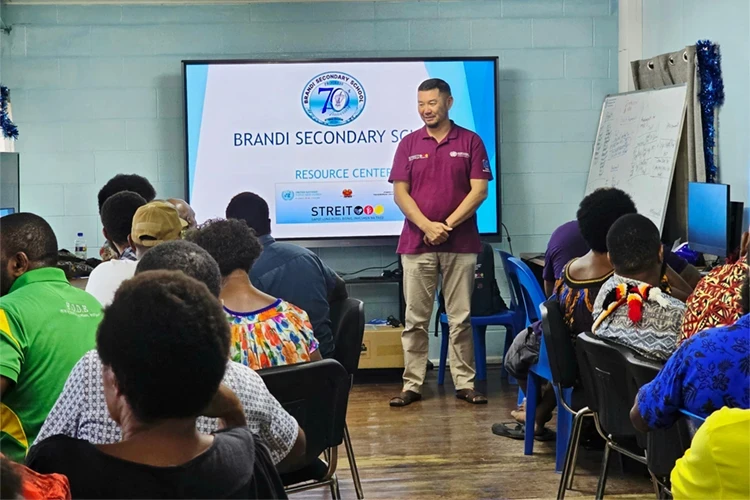

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

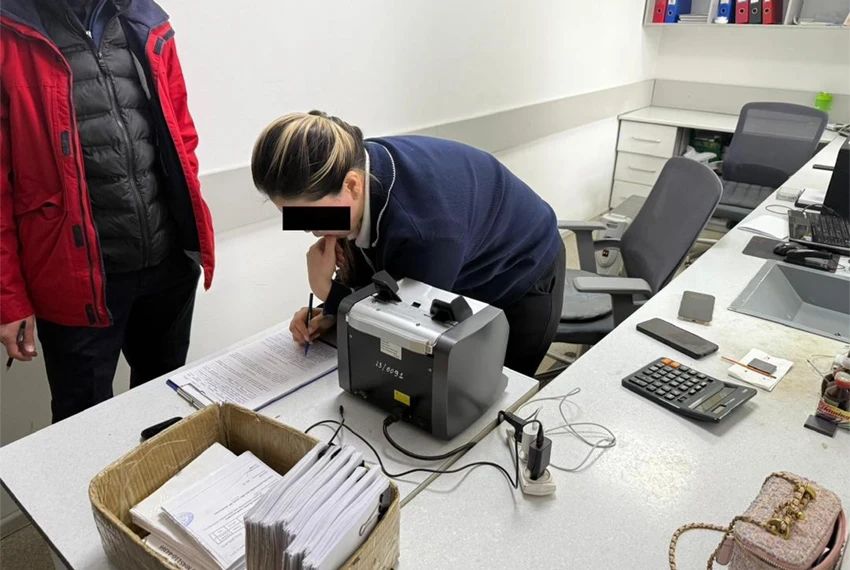

The GKNB Raided Pawnshops in Osh: Dozens of Locations Sealed, Overpricing Discovered

According to information from the State Committee for National Security (GKNB) of the Kyrgyz...

"Neither Drive Nor Walk". Residents of Osh Complained About the Condition of One of the Streets

Residents of Kayyrma Street contacted the Call Center Kaktus.media to express their concerns about...

Franc strengthens amid economic crisis and outpaces other currencies

The decline of the dollar has turned out to be one of the most significant events in finance in...

Year Results from Tazabek. Over 30,000 enterprises in Kyrgyzstan earned nearly 800 billion soms in 2024.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

A Major Loan Shark and Owner of a Pawnshop Chain Arrested

In Bishkek, law enforcement agencies detained a well-known loan shark and owner of a chain of...

To Avoid Inflation and Preserve Value: What Should Investors in Bishkek Do?

In the context of global economic instability and the resurgence of inflation, the period from...

What is happening with green cards? Should we expect the lottery? And what about those who have already won it?

The U.S. Green Card Lottery (Diversity Visa Lottery) has long served as one of the most accessible...

"War Will Change Beyond Recognition." Colonel of the General Staff of Russia — on the Lessons of Military Actions in Ukraine, Changes in the Army, and the Weapons of the Future

The conflict in Ukraine has not only become a catalyst for changes in the military sphere but has...

The Ombudsman checked the conditions of detention in women's colony No. 2

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Rest in Goa: A Guide for Kyrgyzstanis on the Main Tourist Destination in India

Goa is one of the most vibrant and attractive tourist regions in India. Here, everyone will find...

Life in the Regions: A Bullet in the Seat of a Honda — How One Detail Helped Investigator Kurmanbek Kanybek Uulu from Osh Uncover an Organized Crime Group

Kurmanbek Kanybek uulu — an investigator of the control and methodological department of the...

The Tax Service of the Kyrgyz Republic spoke about the liability for using electronic wallets registered to individuals in business activities.

According to the banking legislation of the Kyrgyz Republic, entrepreneurs are required to conduct...

By 2027, the authorized capital of pawnshops in Kyrgyzstan will be increased to 20 million soms

By 2027, it is planned to increase the minimum authorized capital of pawnshops to 20 million soms....

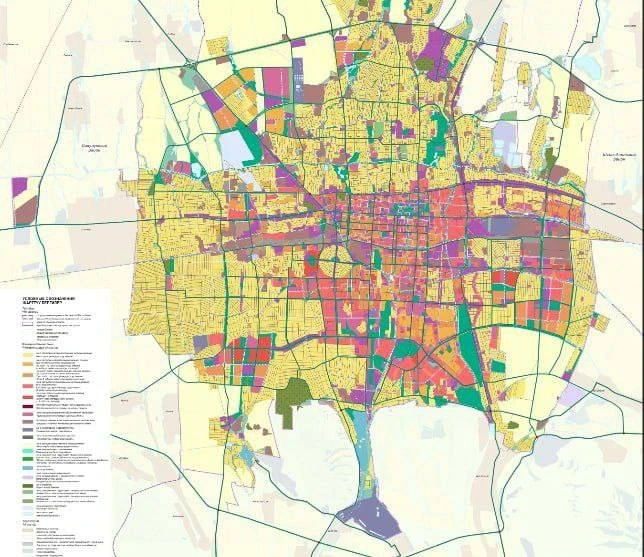

Bishkek Master Plan: Whose Homes and Lands May Be at Risk of Changes

The Bishkek City Hall presented responses to questions and suggestions from residents that were...

Kassym-Jomart Tokayev: Rural Development is a Strategic Task of the State

The President of Kazakhstan presented new powers and responsibilities for the akims of rural...

"Only the political will of the president will save the architectural masterpieces of Bishkek"

The honored architect of the Kyrgyz SSR and candidate of architecture Ishenbay Kadyrbekov recently...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Nelly Nosalik: Advertising on Social Media - The Most Promising Direction

In Kyrgyzstan, there is a growing interest in women's entrepreneurship in the field of...

In Kyrgyzstan, licenses of 35 pawnshops were suspended in a year

In 2025, the activities of 35 pawnshops were suspended in Kyrgyzstan. This information was provided...

The Nomadic World Will Gather in Kyrgyzstan. What to Expect at the VI WMC: Innovations and Program

From August 31 to September 6, 2026, Kyrgyzstan will host the VI World Nomad Games (WNG). At a...

Kyrgyzstan Seeks Solutions to Export Issues for Textile Products to Russia

- Since autumn 2025, the sewing enterprises of Kyrgyzstan have found themselves in a difficult...

Using 30% of Capital to Control 100% of an Asset — Maintaining Position During Periods of Maximum Market Growth

The key to successful real estate investments lies in the ability to choose the right moment to...

Week 24. The detention of the akim, a high-profile murder, and the launch of a solar power plant

Starting from April 1 of next year, teachers and doctors will receive a 100 percent salary...

Bloggers, Journalists, Officials. Who the Ministry of Internal Affairs and the State Committee for National Security Detained in 2025

The year 2025 became significant not only for officials but also for activists and bloggers who...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the State Committee for National Security of the Kyrgyz...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the chairman of the GKNB, Kamchybek Tashiev, visited a specialized school...