In 2025, taxes and insurance contributions collected amounted to 391.8 billion soms

The head of the State Tax Service, Almambet Shykmamatov, noted that compared to 2024, revenues increased by almost 90 billion soms, which corresponds to a growth of 129.6%. In particular, tax revenues rose by 80.2 billion soms, while insurance contributions increased by 9.3 billion.

According to Almambet Shykmamatov, 2024 was an important stage in transitioning to a new tax policy and rethinking the role of the state in the economy.

A transformation occurred from traditional fiscal administration, based on pressure and manual control, to more modern methods that include a service approach, digitalization, and trust.

At the meeting, the results of tax collection, revenues from excise duties on alcoholic products, and measures to combat the illegal turnover of excise goods were also discussed.

Participants of the board were presented with a new information system for tax analysis called "Salyk Kүzөt," aimed at improving tax administration and creating a more transparent economy, as well as reducing tax risks and the influence of the human factor.

Adylbek Kasymaliev positively assessed the work of the State Tax Service in the past year, emphasizing the successful implementation of plans, tax reforms, and the introduction of new digital services for automating processes and reducing administrative barriers.

According to him, the exceeding of planned indicators for tax collection in 2025 indicates an increase in the efficiency of tax administration and the exit of businesses from the shadow economy. He also emphasized the need to continue working in this direction using digital solutions.

The head of the Tax Service noted that such significant growth in state budget revenues was achieved without increasing tax rates, reflecting the conscious policy of the state.

In 2025, a large-scale program was also implemented to reduce the tax burden and expand tax benefits for key sectors of the economy.

Almambet Shykmamatov added that an important result of the reforms was the abandonment of excessive inspections and pressure on businesses, simplification of reporting, and the cancellation of a number of control measures.

Emphasis was placed on digitalization and tax reform, which allowed for a reduction in corruption risks, a decrease in the shadow turnover, and an increase in tax discipline. These changes contributed to the synchronous growth of the economy and tax revenues, confirming the effectiveness of the chosen course.

In conclusion, the chairman of the State Tax Service outlined the priority areas for 2026, including enhancing staff competencies, transitioning to risk-oriented analytics in tax administration, developing a service model, improving the efficiency of tax debt collection, and modernizing digital services.

The strategic goal is to consolidate reforms and create an open, technological, and professional tax service of a new type.

Read also:

Driver reform, words of Zhapikeev, visas, prices, GIC. What was January 2026 like?

January 2026 became particularly lengthy for the residents of Kyrgyzstan. It seems that not days,...

Almambet Shykmamatov: "The 'Salyk Kyzut' System Will Ensure the Whitening and Transparency of the Economy"

Almambet Shykmamatov, the chairman of the State Tax Service of Kyrgyzstan, discussed the...

Chairman of the State Tax Service Almambet Shykmamotov Summarizes the Year

At a recent meeting of the GNS of Kyrgyzstan, Chairman Alambet Shykmamatov summarized the...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Casino Only for Foreigners: Kazakhstan Tries to Repeat the Singapore Trick

Kazakhstan is striving to replicate Singapore's successful experience in creating gambling...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

During a departmental meeting, the Chairman of the State Tax Service, Alambet Shykmamatov,...

Rector Kudaiberdi Kozhobekov: OshSU - the flagship of higher education in Kyrgyzstan

In this interview with the rector of Osh State University, Kudayberdi Kozhobekov, we discuss key...

MDS opposed the project on a national reinsurance operator

- At a recent meeting at the Service for Regulation and Supervision of the Financial Market,...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

Sadyr Japarov and the Head of the State Tax Service Discussed the Reform of the Country's Tax System and "Salyk Kuzot"

At the meeting, Almambet Shykmamatov reported on the progress of the second stage of tax system...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

The Cabinet clarified the procedure for accumulating funds in special accounts of budgetary institutions

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

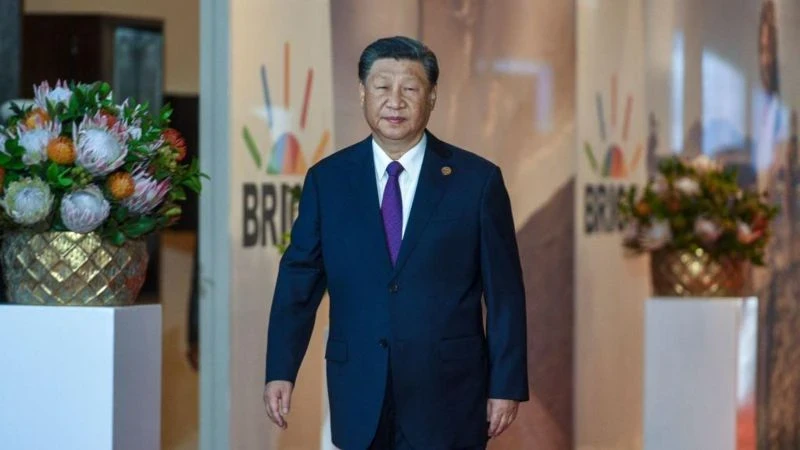

Xi Jinping is conducting purges in the general staff. What does this mean for China and its neighbors, including Central Asia?

Over the weekend, General Zhang Youxia, who held the position of Vice Chairman of the Central...

When Data is Stronger than Bribes: The New "Salyk Kuzot" System Breaks Corruption in the Kyrgyz Republic

In Kyrgyzstan, one of the most modern digital platforms for tax control in the post-Soviet space...

The Customs Service reports a sharp increase in collections. Figures

On January 30, a meeting of the board was held at the State Customs Service of the Kyrgyz Republic,...

What the Labor Market in Kyrgyzstan Was Like in 2025: Salaries, Job Vacancies, Regional Rankings

The labor market is a reflection of social and economic processes, and analysts from the platform...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

The President of Chile is José Antonio Kast, a supporter of dictator Pinochet

José Antonio Kast, representing the far-right political force, has been elected as the President...

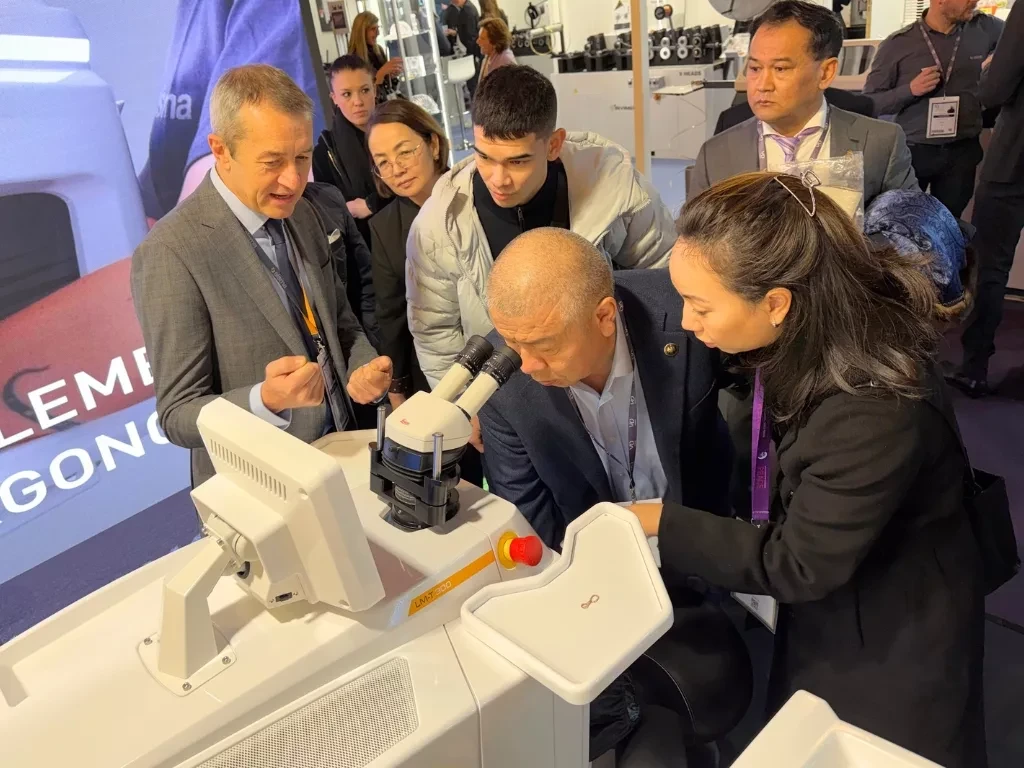

Almambet Shykmamatov participated in the international jewelry exhibition "Vicenzaoro"

During his working visit to Italy, the Chairman of the State Tax Service of the Kyrgyz Republic,...

The Ombudsman checked the conditions of detention in women's colony No. 2

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Sadyra Japarov was presented with the capabilities of the new tax system "Salyk Kuzot"

The President met with the Chairman of the State Tax Service On January 27, the President of...

Cells, Humans, and AI Think Alike — A Group of Scientists Discovered a Common Algorithm

What do a developing embryo, an ant colony, and the latest version of ChatGPT have in common? At...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the State Committee for National Security of the Kyrgyz...

Laboratory Study: The Myth that Boxing Caused Muhammad Ali's Parkinson's Disease

The question of whether boxing caused Muhammad Ali's Parkinson's disease sparks heated...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the chairman of the GKNB, Kamchybek Tashiev, visited a specialized school...

Almambet Shykmamatov shared his thoughts on faith during his pilgrimage to Mecca

In his post, Almambet Shykmamatov shared his personal experiences related to faith during his...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Bishkek Enters the Cycle of Revaluation of the Royal Central Park Real Estate Market and the Advantage of Price Fixation in the First Three Years

The economy, which is on the path of rapid and stable growth, leads to an increase in real estate...

Foreign Workers, Local Sponsors: How Cyber Fraud Schemes with Hotels in Palau Are Organized

New data reveals the mechanisms of operation of two alleged fraudulent centers in Palau, a small...

The sister of Chinghiz Aitmatov addressed the people of Kyrgyzstan (text of the address)

In her address, Roza Torokulovna touches on the topic of malicious rumors and accusations that are...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Kyrgyzstan Seeks Solutions to Export Issues for Textile Products to Russia

- Since autumn 2025, the sewing enterprises of Kyrgyzstan have found themselves in a difficult...

Year Results from Tazabek. Over 30,000 enterprises in Kyrgyzstan earned nearly 800 billion soms in 2024.

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Kazakhstan Introduces Countermeasures Against Russian Automotive Industry in Response to Increased Recycling Fee

Illustrative photo Kazakhstan may impose prohibitive rates for recycling fees on imported cars...

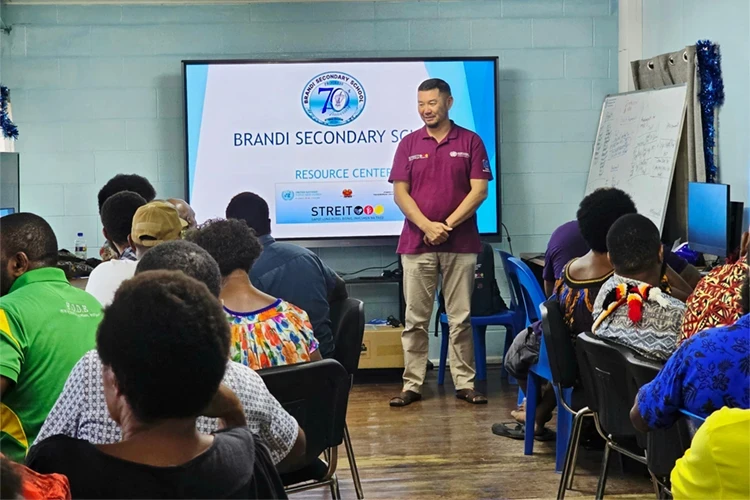

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

In Batken, children were shown a New Year's fairy tale and received gifts from the regional leadership.

In Batken, a New Year's celebration for children was held, organized by the presidential...

Head of the State Tax Service Almaty Shykmamatov discussed cooperation with Italian jewelry brands

During the event, Almambet Shykmamatov familiarized himself with the latest trends in the jewelry...

Sale of the former Prince Andrew's mansion to Kazakh oligarch Kuliayev for £15 million is linked to a bribery scheme, - BBC investigation

A BBC investigation has revealed that Andrew Mountbatten-Windsor received significant sums from an...

The Untouchables. How the Son of a Nazi and a Pinochet Fan Came to Power in Chile

The elections in Chile, which concluded in December with the triumph of the far-right politician...

Now it is not possible to initiate criminal cases for the purpose of conducting unscheduled tax audits, - Head of the State Tax Service A. Shykmamatov on the moratorium

- In accordance with the decree, President Sadyr Japarov has imposed a ban on unscheduled business...

The Minister of Health congratulated children in medical institutions across the country

On December 30, 2025, the Minister of Health of the Kyrgyz Republic, Kanbek Dosmambetov, visited...