Now it is not possible to initiate criminal cases for the purpose of conducting unscheduled tax audits, - Head of the State Tax Service A. Shykmamatov on the moratorium

According to Shykmamatov, scheduled inspections will only be conducted for those companies identified as high-risk within the established system, rather than for all businesses indiscriminately. Typically, such plans are formed for a year.

“If law enforcement agencies initiate a criminal case and send it for inspection, this is considered an unscheduled inspection. The introduced decree prohibits law enforcement agencies from initiating criminal cases without judicial prospects or sufficient grounds,” he explained.

The ban on initiating criminal cases for the purpose of conducting unscheduled tax inspections is now in effect. Businesses are inspected only according to the plan developed by the tax authorities, in accordance with established rules.

The list of inspected companies will include only those with risks of tax non-payment. One of the points of the decree requires the State Tax Service to enhance analytical work for the timely identification of risk-oriented entities that will be included in the inspection plan,” added the head of the State Tax Service.

Context of the event

On January 28, President Sadyr Japarov signed a decree “On the introduction of a temporary ban (moratorium) on the conduct of tax control of business entities.” This was reported by the press service of the President's Administration.

According to the decree, the moratorium on tax control for entrepreneurs registered with the tax authorities will be in effect until December 31, 2026, with the exception of the following cases:

– on-site thematic, scheduled, and counter inspections;

– inspections during the liquidation of an organization or termination of the activities of an individual entrepreneur at their request;

– desk audits;

– raid tax control and monitoring compliance with the use of cash registers for entrepreneurs operating under the general or simplified tax regime, as well as for those engaged in the production and/or sale of jewelry and excise goods.

Law enforcement agencies are instructed not to initiate criminal cases if there is insufficient evidence indicating signs of a crime, in order to avoid initiating unscheduled tax inspections against entrepreneurs.

Read also:

In Kyrgyzstan, the moratorium on tax audits has been extended. The President signed the decree.

The President of Kyrgyzstan, Sadyr Japarov, has signed a decree introducing a temporary moratorium...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

Chairman of the State Tax Service Almambet Shykmamotov Summarizes the Year

At a recent meeting of the GNS of Kyrgyzstan, Chairman Alambet Shykmamatov summarized the...

Why Are Merchants Afraid of QR Payments? - Interview with the Deputy Head of the State Tax Service

Recent discussions on social media and in the media have revealed that many sellers in markets...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

In Kyrgyzstan, there are plans to reintroduce a ban on business inspections. But there may be exceptions.

The draft presidential decree, developed by the Ministry of Economy and Commerce, proposes the...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

During a departmental meeting, the Chairman of the State Tax Service, Alambet Shykmamatov,...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

A moratorium on conducting inspections regarding the use of cashless payments among small and medium-sized businesses (POS terminals, electronic wallets, and QR codes) has been introduced in Kyrgyzstan.

The State Tax Service of Kyrgyzstan has announced a temporary halt to raids and control purchases...

The President of Uzbekistan dismissed the head of the State Assets Management Agency and "cleaned up" the Tax Committee

Akmalhon Ortikov. The President noted that during inspections of state structures, such as...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

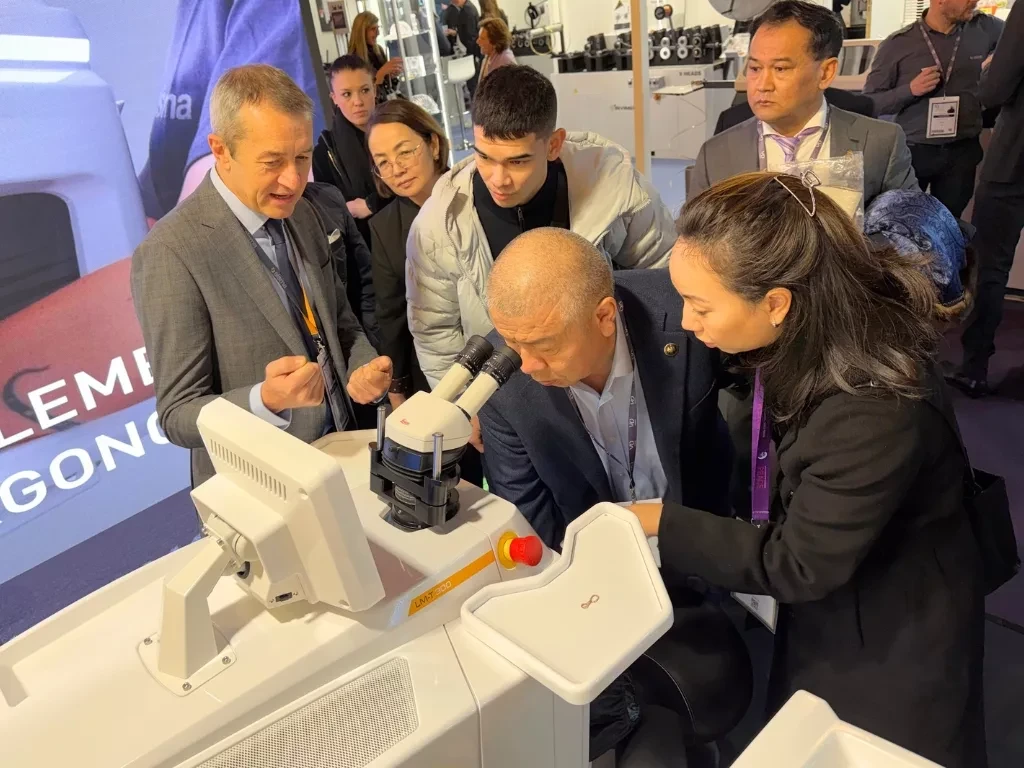

Almambet Shykmamatov participated in the international jewelry exhibition "Vicenzaoro"

During his working visit to Italy, the Chairman of the State Tax Service of the Kyrgyz Republic,...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

A temporary ban on the import of electronic cigarettes has been imposed in Kyrgyzstan.

The Cabinet of Ministers of Kyrgyzstan has issued a decree introducing a temporary ban on the...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Life in the Regions: A Bullet in the Seat of a Honda — How One Detail Helped Investigator Kurmanbek Kanybek Uulu from Osh Uncover an Organized Crime Group

Kurmanbek Kanybek uulu — an investigator of the control and methodological department of the...

In Kyrgyzstan, the ban on the export of waste paper has been extended.

In accordance with the provisions of Articles 29 and 47 of the Treaty on the Eurasian Economic...

The President signed a decree on a temporary national campaign for free driver's license replacement.

The President of the Kyrgyz Republic, Sadyr Japarov, has issued a decree regarding the organization...

The Tax Service suspended raids and control purchases from entrepreneurs, including those involving QR codes.

The State Tax Service (STS) has announced the suspension of raid inspections and control purchases...

Authorities propose to introduce a moratorium on business inspections until the end of 2026

A draft presidential decree has been presented for public consideration, which proposes the...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

The Ministry of Science proposes to ban the transfer of foreigners to higher courses of medical universities.

The Ministry of Science, Higher Education, and Innovations has presented a draft resolution of the...

What is happening with green cards? Should we expect the lottery? And what about those who have already won it?

The U.S. Green Card Lottery (Diversity Visa Lottery) has long served as one of the most accessible...

Head of the State Tax Service Almaty Shykmamatov discussed cooperation with Italian jewelry brands

During the event, Almambet Shykmamatov familiarized himself with the latest trends in the jewelry...

The law on amendments to taxes, social insurance, and non-tax revenues has been adopted. What will change?

The President of the Kyrgyz Republic, Sadyr Japarov, has signed a law concerning changes in the...

Sadyr Japarov and the Head of the State Tax Service Discussed the Reform of the Country's Tax System and "Salyk Kuzot"

At the meeting, Almambet Shykmamatov reported on the progress of the second stage of tax system...

The Ministry of Economic Development reminded about the ban on pawnshops accepting real estate as collateral.

- In Kyrgyzstan, pawnshops are authorized to issue short-term loans exclusively against movable...

State Franchise and Mandatory Accreditation: President Zaparov Signed a Law Regulating Medical Education.

President Sadyr Japarov signed new legislation "On Amendments to Certain Legislative Acts in...

The Tax Service of the Kyrgyz Republic spoke about the liability for using electronic wallets registered to individuals in business activities.

According to the banking legislation of the Kyrgyz Republic, entrepreneurs are required to conduct...

"Young Talents": When a Hobby Becomes a Good Deed — The Story of 16-Year-Old Aziza from Karakol

Aziza Ruzieva is a 10th-grade student at Secondary School No. 1 named after Aldayar Uulu Moit Ake...

The Housing Committee approved the bill that Bekeshev called cannibalistic and anti-people.

Deputy Dastan Bekeshev expressed protest against changes to the Criminal Executive, Criminal, and...

Working Abroad: How to Earn 300,000 Soms and Avoid Becoming a Victim of Fraudsters

Photo from the internet. Baktybek Kudayberdiev In recent years, there has been an increase in the...

Almambet Shykmamatov shared his thoughts on faith during his pilgrimage to Mecca

In his post, Almambet Shykmamatov shared his personal experiences related to faith during his...

Tax collection figures reached a historic high - Head of the State Tax Service

At a hardware meeting held by the head of the Tax Service of Kyrgyzstan, Almambet Shykmamatov, the...

Did Trump Exchange Taiwan and Ukraine for Venezuela?

Analyzing recent events, Jaykhun Ashirov reflects on why the theory of a conspiracy between the...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

Rest in Goa: A Guide for Kyrgyzstanis on the Main Tourist Destination in India

Goa is one of the most vibrant and attractive tourist regions in India. Here, everyone will find...

Mexico bans the use of dolphins, whales, and other marine mammals for entertainment purposes

The Senate of Mexico has completed a three-year legislative initiative, unanimously approving a...

Almambet Shykmamatov: Laboratories for Testing Imported Jewelry Will Open at Airports

Today, December 24, at a meeting of the Jogorku Kenesh, the Chairman of the State Tax Service,...

Sadyra Japarov was presented with the capabilities of the new tax system "Salyk Kuzot"

The President met with the Chairman of the State Tax Service On January 27, the President of...

"Only the political will of the president will save the architectural masterpieces of Bishkek"

The honored architect of the Kyrgyz SSR and candidate of architecture Ishenbay Kadyrbekov recently...

Week-24. Officials went on a pilgrimage, while Bishkek continues to lose its history

In Kyrgyzstan, the New Year holidays are coming to an end, and during this time the republic...

48 countries launch a unified cryptocurrency tax control system

Starting January 1, 2026, a new Reporting System for Crypto Assets (CARF) will come into effect,...

The GNS announced that for the first time in the history of independent Kyrgyzstan, it has prematurely fulfilled the plan for tax and payment collection.

The State Tax Service has successfully completed the approved plan for tax and payment collection...

Minimum Wage, Average Salary, and Reality: Are They Connected?

The National Statistical Committee has published data on the minimum subsistence level and average...

Salaries, retirement age, and new fines. What else will change in the KR in 2026

Starting from January 1, 2026, a comprehensive set of new laws will come into effect in Kyrgyzstan....