The Head of the State Tax Service Discussed the Transformation of Tax Administration

He noted that in 2025, a significant policy will be implemented to reduce the tax burden and increase tax benefits for key sectors of the economy. The main areas will be agriculture, processing, information technology, renewable energy sources, as well as the textile and jewelry industries, including the development of sports.

“Small and medium-sized businesses have been given the right to choose the most convenient tax regime — general, single tax, or patent. This decision has allowed entrepreneurs to align their tax obligations with the actual scale of their activities, while the state has been able to form a stable tax base. To date, tax rates in Kyrgyzstan are among the lowest in the post-Soviet space, which represents a strategic advantage for the country in attracting investments and developing human capital,” emphasized Alambet Shykmamatov.

He added that the main aspect of the 2025 reforms is a radical change in approaches to tax administration.

“We have abandoned excessive checks and pressure on businesses, understanding that fear cannot be a sustainable source of budget revenues. In particular, on-site inspections by employees of the central office of the State Tax Service have been canceled, which has helped reduce corruption risks at this level.

Moreover, we have revised the methods of appointing and conducting inspections in territorial divisions, creating a control system focused on the validity and quality of inspections,” added the head of the State Tax Service.

In his opinion, tax administration has become significantly simpler for both businesses and citizens.

Since January 1 of this year, the mandatory use of electronic waybills for most goods has been canceled, a moratorium on control purchases and raids in markets has been introduced, as well as the cancellation of the universal tax declaration for individuals who are not individual entrepreneurs and the need to submit "zero" reports.

“These measures have freed up time and resources for businesses, which should contribute to economic development. It is also important to note the policy of legalizing economic activity. The opportunity to legalize goods without penalties until April 1, 2025, and the write-off of tax debts for previous periods have become an important signal that the state wants to create conditions for a fair future,” added Alambet Shykmamatov.

One of the central elements of the reform was the change in taxation for markets and shopping centers.

The return of the patent system, exemption from the mandatory use of cash registers, an increase in the annual revenue threshold to 50 million soms, and the introduction of reduced rates for the jewelry industry were adopted based on dialogue with entrepreneurs.

“The pilot project in the markets of ‘Dordoy,’ ‘Kara-Suu,’ and ‘Madina,’ where administrations act as tax agents, has demonstrated that eliminating the human factor and direct contact significantly reduces the risks of abuse and increases discipline,” noted the chairman of the Tax Service.

As he reported, the most important component of all transformations has been digitalization.

“In 2025, tax administration has significantly transitioned to remote formats. The functionality of the ‘Taxpayer’s Cabinet’ has been expanded, automated tax risk management systems have been implemented, and a pilot project for fiscal software with data transmission has been launched. The integration of accounting systems of catering enterprises with the information system of the State Tax Service has already shown positive results in the form of increased average daily revenue and a reduction in the shadow turnover,” noted Alambet Shykmamatov.

Modernization of the electronic invoice system with a virtual warehouse mechanism continues, along with the implementation of the ‘Salyk Kyzut’ module, which will allow tracking the movement of goods from import or production to the end consumer.

“These changes represent not just technological solutions, but a transition to a system where the rules are the same for everyone and work automatically. The results of tax reforms harmoniously fit into the overall macroeconomic dynamics. According to the National Statistical Committee, the gross domestic product for January-December of last year amounted to almost 2 billion soms, which corresponds to an 11 percent growth. For the first time in recent years, the growth of the economy and tax revenues demonstrates such clear synchrony, confirming that tax reform has become a driver of development rather than an obstacle,” summarized the head of the State Tax Service.

Read also:

Driver reform, words of Zhapikeev, visas, prices, GIC. What was January 2026 like?

January 2026 became particularly lengthy for the residents of Kyrgyzstan. It seems that not days,...

Tokayev: Kazakhstan has entered a new stage of modernization

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Cells, Humans, and AI Think Alike — A Group of Scientists Discovered a Common Algorithm

What do a developing embryo, an ant colony, and the latest version of ChatGPT have in common? At...

Casino Only for Foreigners: Kazakhstan Tries to Repeat the Singapore Trick

Kazakhstan is striving to replicate Singapore's successful experience in creating gambling...

Aeon: How the Conquest of Foreign Territories Came to Be Considered Unacceptable

Author: Cary Goettlich In the modern world, there are fewer and fewer things that evoke consensus...

"Sometimes Harsh, but Necessary". How Entrepreneurs Assess the Year 2025

According to the analytical forecast of the Central Bank, it is expected that by the end of 2025,...

The head of the White House staff stated that her sharp comments about Musk and Vance were taken out of context.

On December 16, Vanity Fair published the first part of an extensive article based on numerous...

Non-Combat and Unrecognized: Suicides in the Ukrainian Army That Are Silent

This is a translation of an article from the Ukrainian service of the BBC. The original is...

The J-1 Cultural Exchange Program in the USA has turned into a scheme for profiting from and exploiting foreign interns, - The New York Times

Another scheme involved employing close relatives of the CEO, which brought his family over 1...

What the Labor Market in Kyrgyzstan Was Like in 2025: Salaries, Job Vacancies, Regional Rankings

The labor market is a reflection of social and economic processes, and analysts from the platform...

Sadyr Japarov spoke at the IV People's Kurultai (text of the speech)

Today, December 25, the President of Kyrgyzstan, Sadyr Japarov, addressed the people, the deputies...

Problems of Diagnosing Hip Joint Dysplasia in Kyrgyzstan. Archival Interview with Kasymbek Tazabekov

In Kyrgyzstan, orthopedic diseases remain one of the key medical problems. According to the...

Tokaev gave a major interview to the Turkistan newspaper. It covers reforms, AI, nuclear power plants, Nazarbayev, and much more.

President Kassym-Jomart Tokaev shared his views on current challenges and achievements in his...

Rector Kudaiberdi Kozhobekov: OshSU - the flagship of higher education in Kyrgyzstan

In this interview with the rector of Osh State University, Kudayberdi Kozhobekov, we discuss key...

Bishkek Enters the Cycle of Revaluation of the Royal Central Park Real Estate Market and the Advantage of Price Fixation in the First Three Years

The economy, which is on the path of rapid and stable growth, leads to an increase in real estate...

How "Eurasia" is Changing the Daily Lives of Millions in Kyrgyzstan

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

Xi Jinping is conducting purges in the general staff. What does this mean for China and its neighbors, including Central Asia?

Over the weekend, General Zhang Youxia, who held the position of Vice Chairman of the Central...

Bishkek Resident Reported Police Inaction on Child Abuse by Their Father

Aizhamal D. from Bishkek reported to Kaktus.media that the police have been inactive in response to...

The sister of Chinghiz Aitmatov addressed the people of Kyrgyzstan (text of the address)

In her address, Roza Torokulovna touches on the topic of malicious rumors and accusations that are...

In 2025, taxes and insurance contributions collected amounted to 391.8 billion soms

According to the report from the Tax Service, in 2025, taxes and insurance contributions amounting...

Russian and Ukrainian Drone Manufacturers Buy Components from the Same Chinese Companies

According to The Financial Times, Russian and Ukrainian drone manufacturers are using the same...

Laboratory Study: The Myth that Boxing Caused Muhammad Ali's Parkinson's Disease

The question of whether boxing caused Muhammad Ali's Parkinson's disease sparks heated...

The Economy of Kyrgyzstan - 2025: Growth Records and Price Shocks

In 2025, Kyrgyzstan found itself at a crossroads, facing stark contrasts in its economy. On one...

Chairman of the State Tax Service Almambet Shykmamotov Summarizes the Year

At a recent meeting of the GNS of Kyrgyzstan, Chairman Alambet Shykmamatov summarized the...

Zelensky spoke about the 20 points of the peace plan. What's new in it?

President of Ukraine Volodymyr Zelensky presented a draft agreement for ending the war, which was...

Personnel Changes in the Chinese Army: Assessments by Global Media

In recent weeks, China has witnessed significant upheaval within its military and political...

The President of Chile is José Antonio Kast, a supporter of dictator Pinochet

José Antonio Kast, representing the far-right political force, has been elected as the President...

Sale of the former Prince Andrew's mansion to Kazakh oligarch Kuliayev for £15 million is linked to a bribery scheme, - BBC investigation

A BBC investigation has revealed that Andrew Mountbatten-Windsor received significant sums from an...

Voting - a right or a duty? The controversial bill of the deputy

Deputy Marlen Mamataliyev has proposed making participation of citizens of Kyrgyzstan in elections...

Nelly Nosalik: Advertising on Social Media - The Most Promising Direction

In Kyrgyzstan, there is a growing interest in women's entrepreneurship in the field of...

"War Will Change Beyond Recognition." Colonel of the General Staff of Russia — on the Lessons of Military Actions in Ukraine, Changes in the Army, and the Weapons of the Future

The conflict in Ukraine has not only become a catalyst for changes in the military sphere but has...

The Ombudsman checked the conditions of detention in women's colony No. 2

Curl error: Operation timed out after 120001 milliseconds with 0 bytes received...

What is happening with green cards? Should we expect the lottery? And what about those who have already won it?

The U.S. Green Card Lottery (Diversity Visa Lottery) has long served as one of the most accessible...

USA and UK Withdraw Part of Personnel from Military Base in Qatar. Iran's Air Defense on High Alert

The American and British troops at Al Udeid base are facing potential threats, leading to the...

Like Another Planet. A Kyrgyz Person on Life in Papua New Guinea and Working at the UN

Kанагат Алышбаев, a native of the village of Sary-Kamysh in the Issyk-Kul region, holds a degree...

To Avoid Inflation and Preserve Value: What Should Investors in Bishkek Do?

In the context of global economic instability and the resurgence of inflation, the period from...

Why Did Trump Invite Only Kazakhstan and Uzbekistan from Central Asia to the "World Council"? Opinions

On January 16, U.S. President Donald Trump announced the creation of a new international structure...

Foreign Workers, Local Sponsors: How Cyber Fraud Schemes with Hotels in Palau Are Organized

New data reveals the mechanisms of operation of two alleged fraudulent centers in Palau, a small...

The GKNB donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the chairman of the GKNB, Kamchybek Tashiev, visited a specialized school...

The Untouchables. How the Son of a Nazi and a Pinochet Fan Came to Power in Chile

The elections in Chile, which concluded in December with the triumph of the far-right politician...

Historical Maximum: The State Tax Service Exceeded the Tax Plan by 46.5 Billion Soms

During a departmental meeting, the Chairman of the State Tax Service, Alambet Shykmamatov,...

Published the content of the draft new Constitution of Kazakhstan. Text

At the meeting of the Constitutional Commission, key points of the new draft Constitution of...

The State Committee for National Security of the Kyrgyz Republic donated 1 million soms and gifts to the special school for the hearing impaired.

On December 26, 2025, the Chairman of the State Committee for National Security of the Kyrgyz...

Open a Company in Hong Kong

Hong Kong, due to its strategic location, has become a crucial point in global commerce. Opening a...

Life in the Regions: A Bullet in the Seat of a Honda — How One Detail Helped Investigator Kurmanbek Kanybek Uulu from Osh Uncover an Organized Crime Group

Kurmanbek Kanybek uulu — an investigator of the control and methodological department of the...

Trump stated that the U.S. should "own" Greenland to prevent its takeover by Russia and China.

Donald Trump, the President of the United States, emphasized that the United States must...

UFC Fighters Coach: How Tynchtykbek Omurzakov Trains Athletes. Interview

Tynchtykbek Omurzakov is a coach who has opened the way for many mixed martial arts fighters from...

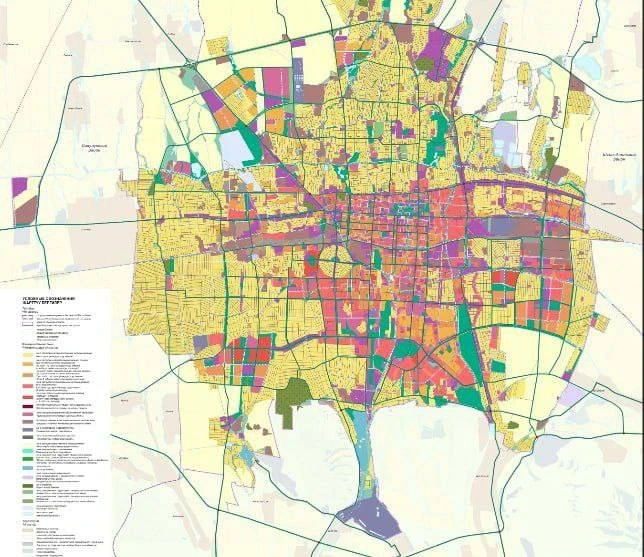

Bishkek Master Plan: Whose Homes and Lands May Be at Risk of Changes

The Bishkek City Hall presented responses to questions and suggestions from residents that were...