More than 140,000 people have connected the self-restriction service for lending in the Kyrgyz Republic.

This mechanism was implemented in Kyrgyzstan on November 1, 2025, with the aim of reducing cases of fraud and protecting citizens from obtaining loans without their knowledge.

Citizens can freely set or remove the self-restriction through the state electronic services portal, and the information about the restriction is transmitted to the selected credit bureaus.

Financial institutions are required to check for the existence of a self-restriction and to deny credit if such a restriction is in place.

The legislative changes that introduced this mechanism were signed by the president in the summer of 2025.

Read also:

Nearly 114 thousand Kyrgyz citizens have imposed a self-ban on borrowing.

From November 1 to December 26, 2025, 113,996 citizens decided to take advantage of the self-ban...

The National Bank reported how many Kyrgyz citizens have imposed a self-ban on borrowing.

From November 1, 2025, to January 16, 2026, 140,264 citizens of Kyrgyzstan used the...

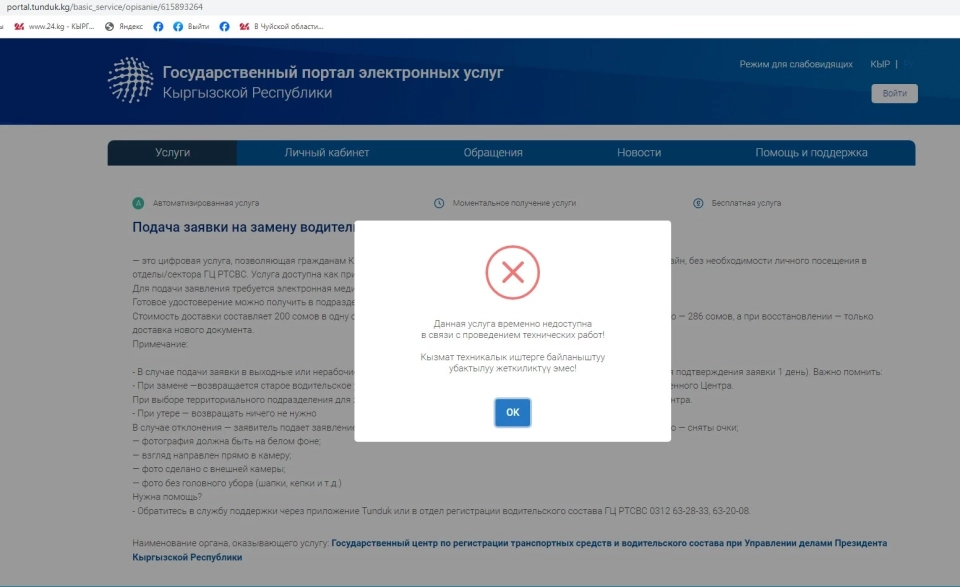

Online replacement of driver's licenses through "Tündük" is temporarily unavailable

Currently, the submission of applications for the replacement of driver's licenses through...

In 2025, the National Bank laid the legal foundation for the transition to a digital som.

In 2025, the Kyrgyz National Bank announced the implementation of legal foundations for the...

In the Moscow District, the CCO 08-04 serves citizens through the "Tündük" app

The Public Service Center 08-04 in the Moscow district of the Chui region, recognized as the best...

How the Public Service Centers Will Operate During the New Year Holidays (Schedule)

In connection with the New Year celebrations, the operation of the Public Service Centers (PSC)...

It's important: currency exchange offices in Kyrgyzstan will verify the origin of your funds

Starting from January 14, new rules approved by the National Bank regarding the operation of...

AI will take driving license exams in Kyrgyzstan

All curricula for driving schools in Kyrgyzstan have already been approved, as reported by...

In 2025, 35 violations of phytosanitary requirements were identified, - Ministry of Agriculture

- In 2025, 35 cases of non-compliance with phytosanitary requirements were detected in Kyrgyzstan...

The Ministry of Foreign Affairs is negotiating to reduce the deposit for obtaining a visa to the USA

The head of the Ministry of Foreign Affairs, Jeenbek Kulubaev, stated at a press conference that...

In Kyrgyzstan, artificial intelligence will be implemented in tax audits in 2026

In 2026, the use of artificial intelligence in the process of tax audits will begin in Kyrgyzstan,...

The Head of the National Bank of Kyrgyzstan Discussed the Achievements of the Country's Financial System

2025 turned out to be a significant year for the entire financial sphere of Kyrgyzstan. The...

The population of Kyrgyzstan is approaching 7.4 million people

According to the National Statistical Committee, from January to October 2025, the permanent...

777 people received a protection order in the Jalal-Abad region last year

In 2025, 847 cases of domestic violence were registered in the Jalal-Abad region, as reported by...

The Public Service Centers of Kyrgyzstan provided 3.6 million services, of which 527 thousand were in online format.

In Kyrgyzstan, 3 million 600 thousand requests were registered at the public service centers...

In Bishkek, energy providers will disconnect more than 5,500 subscribers due to debts

In connection with the disconnections, the company reminds that there is a section on its website...

In 2025, more than 200 Kyrgyz nationals were expelled from the Novosibirsk region of the Russian Federation.

In 2025, more than 200 citizens of Kyrgyzstan were deported from the Novosibirsk region of Russia,...

In Bishkek, a woman gave nearly $50,000 to unknown individuals for the purchase of an apartment

In the capital of Kyrgyzstan, Bishkek, a serious case of internet fraud has been recorded....

A resident of Bishkek transferred nearly $50,000 to scammers via WhatsApp

On November 12, 2025, N. V. filed an official statement with the Internal Affairs Department of the...

The GKNB detained a man who was using connections with the President of the Kyrgyz Republic as a cover.

The specialists of the State Committee for National Security (GKNB) detained a man named S.U.E.,...

In January-November 2025, 1,446 crimes against elderly citizens were registered.

According to data presented by the National Statistics Committee, from the beginning of January to...

The accumulated part of the pension in Kyrgyzstan was received by 227 thousand people

Some citizens withdrew their savings early As of December 1, 227,354 people received the funded...

The National Bank fined two exchange offices in Bishkek 110,000 soms.

- The National Bank of Kyrgyzstan has imposed fines of 55,000 soms on two exchange offices located...

Government agencies will be required to allocate 1 percent of the budget for scientific research

The Cabinet of Ministers has made a decision on the procedure for organizing research work in state...

The Cabinet approved the protocol with the Russian Federation on exempting the RKFR from paying insurance contributions and other social deductions.

- The Cabinet of Ministers of the Kyrgyz Republic approved the protocol signed between the...

ACRA has upgraded Kyrgyzstan's long-term credit rating to BB-

The credit rating agency AKRA has announced an upgrade of Kyrgyzstan's long-term credit rating...

A Visa Deposit Introduced for Citizens of Kyrgyzstan When Applying for a Visa to the USA

Photo from the internet Starting from January 21, 2026, citizens of Kyrgyzstan who plan to apply...

In Kyrgyzstan, about 40,000 officially registered unemployed have been counted

Photo from the internet As of December 1, 2025, the official unemployment rate in Kyrgyzstan is...

The number of refugees from Ukraine to the European Union has risen to 4.33 million people

As of the end of November 2025, the number of Ukrainian refugees who received temporary protection...

"Salik Service" Implemented AI and Simplified Tax Reports for Citizens

The State Enterprise "Salyk Service" announced its significant achievements over the...

Exchangers will be able to verify the origin of clients' funds, including those of foreigners

The Board of the National Bank of the Kyrgyz Republic has approved a new regulation establishing...

The National Bank fined a resident of Jalal-Abad region 17,500 soms for illegal currency exchange.

- In the Jalal-Abad region, a citizen with the initials T.N.M. was fined 17,500 soms for conducting...

The National Bank revoked the license of the credit union "Dividend" in the Batken region

- On December 23, 2025, the Batken regional office of the National Bank made the decision to revoke...

The volume of money transfers to Kyrgyzstan exceeded $3 billion

According to the National Bank, the total volume of money transfers to Kyrgyzstan in November last...

Tax Service of the Kyrgyz Republic: Online Re-registration Service for Individual Entrepreneurs Launched

The State Tax Service of Kyrgyzstan has announced the launch of a new online service for...

National Bank: Requirements for Operations in Exchange Offices Tightened in Kyrgyzstan

The National Bank of Kyrgyzstan has announced the introduction of stricter requirements for...

Speed Control by Average Speed is Being Introduced on Roads in Kyrgyzstan

7,406 violations detected The average speed control on the roads of the country will be...

In Kyrgyzstan, penalties for violations during the import of goods and vehicles into the country have been tightened.

In Kyrgyzstan, measures have been taken to increase responsibility for the illegal import of goods...

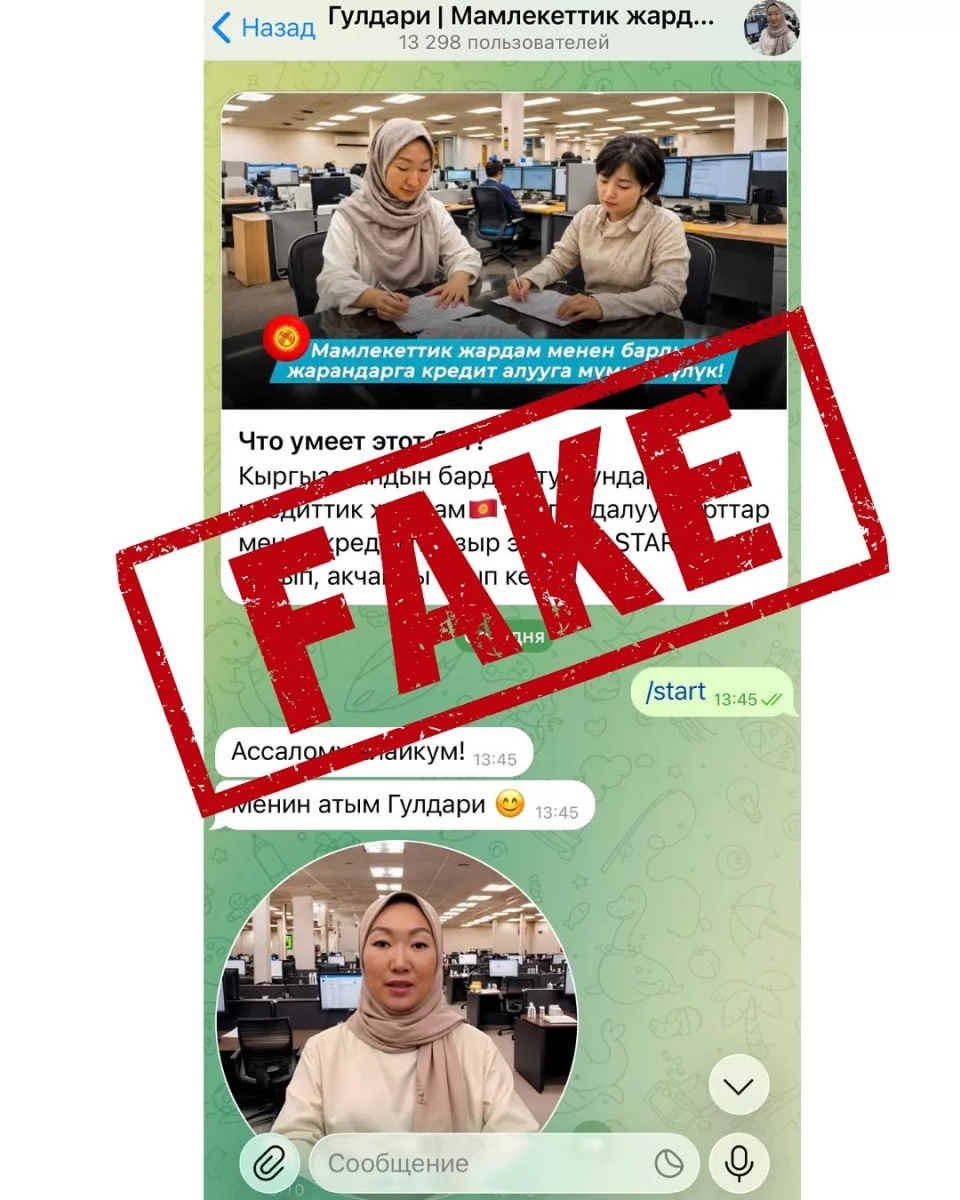

The National Bank of Kyrgyzstan Reminds and Again Warns About a Fraud Scheme in the Messenger Telegram

The National Bank once again draws attention to fraudulent schemes that are spreading through the...

New Year Greetings with a Twist: The Ministry of Internal Affairs Warns About Fraudsters

As the New Year holidays approach, the Ministry of Internal Affairs reports a sharp increase in...

The Ministry of Health reported how many people fell ill with influenza and ARVI at the beginning of 2026.

The decline in the incidence of influenza and ARVI continues in Kyrgyzstan, as reported by the...

Artificial Intelligence Used in Tax Audits in Kyrgyzstan

As reported in the press release from the State Tax Service, the GKU "Salyk Service" will...

In Kyrgyzstan, the requirements for banks' charter capital have been raised

On December 29, 2025, the Board of the National Bank of the Kyrgyz Republic approved resolution No....

Internal Affairs Department of Batken Region: 769 Cases of Domestic Violence Recorded in 2025

In 2025, there were 769 incidents of domestic violence recorded in the Batken region, according to...

Replacement of indefinite rights: Medical certificate 083 will be excluded from "Tündük" starting January 19

The head of the President's Office, Kanaybek Tumanbaev, visited the State Center for Vehicle...

For citizens of the Kyrgyz Republic, a visa deposit has been introduced when processing entry documents to the USA.

Photo from the internet Starting January 21, 2026, citizens of Kyrgyzstan applying for...

The border service reminded about the rules for Kazakhstani citizens staying in Kyrgyzstan.

Starting from September 1, 2025, new rules for citizens of Kazakhstan regarding their stay in...

A Visa Deposit is Introduced for Citizens of Kyrgyzstan Traveling to the USA

A pilot project with new requirements will begin on January 21, 2026 With the introduction of new...