It is projected that by 2030, the National Wealth Fund of Mongolia will accumulate ₮24 trillion (approximately $6.8 billion).

In the last two years, the fund has been actively transforming from an investment entity into a system with a clear structure, rules, and governance. This means that the discussion phase is over, and real implementation is beginning.

🧐 What is the purpose of the wealth fund?

In an economy heavily dependent on natural resources, the activation of mineral extraction leads to increased exports and higher budget expenditures, but there always remains the question of the future. This is where the idea of the wealth fund arises—a system aimed at preserving, increasing, and passing on a portion of the income from natural resources to future generations.

⁇ Is it necessary to have a fund? The country's economy is subject to fluctuations in commodity prices. During periods of rising prices, revenues increase sharply, but when they fall, it negatively impacts the budget, exchange rate, and standard of living. The main task of the wealth fund is to smooth out fluctuations and balance revenues.

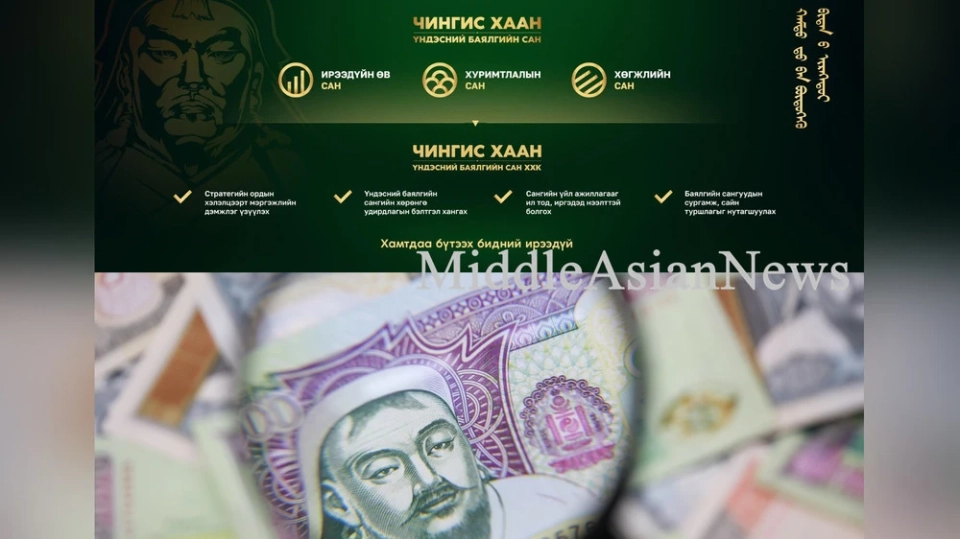

🔍 How does it work? The creation of the wealth fund has been discussed at the political level for many years, and its foundations were laid in 2016. The legal framework was established in 2024, and the fund began receiving its first revenues. This year, the "Chinggis Khaan National Wealth Fund" company was established to manage the fund's assets.

📈 What has already been done?

As of October 2023, ₮5.2 trillion (about $1.5 billion) has been invested in the Future Heritage Fund, and ₮752 billion (approximately $211.69 million) in the Savings Fund. It is expected that by 2030, depending on the growth of mining exports, the assets of the Future Heritage Fund will increase 3.7 times to ₮19.3 trillion (about $5.4 billion), and the assets of the Savings Fund will increase 5.5 times. A development fund structure is currently being developed to manage the assets, with revenues expected from it starting in 2029.

📌 What will the funds be used for?

The assets of the Future Heritage Fund will be kept in the form of cash deposits in the largest central banks in the world. Expenditures will begin in 2030, when 10% of the net interest income for the year will be transferred to the state budget. The remaining 90% and all accumulated assets will be passed on to future generations of Mongolia.

🏡 Why is this necessary?

The accumulated funds in the Savings Fund directly affect the quality of life of citizens. Each of the state mining companies contributed ₮500 billion (approximately $140.7 million) from their profits for 2023 and 2024 to the Savings Fund. In the future, revenues from the private sector from the sale of special mineral resources will also be directed to this fund. The current assets of the fund are used to finance mortgage loans, which will subsequently be reinvested in the fund through monthly payments from borrowers. The dividends received by the fund will be distributed among all citizens, and from 2030, citizens will be able to use the funds in their accounts.

In summary… The concept of a sovereign wealth fund is just beginning to align with international standards, principles, and best practices, which will lay the foundation for politically neutral, transparent, and accountable governance. In the future, control, efficiency, and proper distribution remain important aspects.

Tatar S. Maidara

source: MiddleAsianNews